Maximizing Your Property’s Potential: What you need to know about Middle Housing

Higher-density housing is happening in our state and quite possibly right in your own backyard. This is called middle housing. Middle housing is a term for buildings that are compatible in scale, form, and character with detached single-family houses. In 2023, House Bill 1110 was passed in a bipartisan 35-14 vote in the Senate and 79-18 vote in the House, and is likely to affect most homeowners and purchasers by the summer of 2025 when state law requires local municipalities to enact changes to their local codes. The state’s intention behind HB 1110 is to help provide more affordable housing options in the wake of the Washington State housing affordability crisis, which in turn, creates more density. It has been over a year since this was enacted and municipalities are starting to process and absorb these changes, and middle housing is coming to life.

Some items to consider are listed below:

- Cities with more than 75k people must allow 4 units per lot; they must allow 6 units if within a quarter mile of a (major) transit stop, among other rules.

- Cities between 25k-75k must allow 2 units per lot, among other rules.

- Cities with fewer than 25k have to allow 2 units per lot.

- Cities may not enact standards for middle housing that are more restrictive than for single-family housing.

- Cities may not require off-street parking as a condition of permitting.

Putting political opinions aside, I want to help bring understanding to this option for homeowners and potential homebuyers. The call for higher density has allowed for some properties to be condominium-ized (creating units) vs. subdivided lots in order to add Accessory Dwelling Units (ADU). This is a much simpler process that can be done on smaller-sized properties vs. the larger lot requirements of subdivision. These ADUs can either be attached (AADU) or detached (DADU) and it depends on the size of the property and the location. Here is an example of what one could look like in the City of Seattle.

The City of Seattle has building guidelines that align with creating this density more easily via smaller building setbacks and tax requirements. Other cities have more restrictive requirements, it is location-dependent on how this will play out. Additionally, if a neighborhood has Covenants, Conditions, and Restrictions (CC&Rs) that were recorded before HB 1110 went into effect that prohibit ADUs, then this development will not be allowed despite the legislative change. Assessing this development potential starts with researching CC&Rs (if applicable) and inquiring with the city and/or county planning department where the property is located.

If a property is eligible for this type of growth, getting the condominium approved is a rather quick task. The condo map and declaration need to be drafted and recorded to be official and can take anywhere from 6-10 weeks depending on the responsiveness and availability of a qualified surveyor. The map will address the number of units, where they are located, Common Elements, and Limited Common Elements. The total cost for creating and recording these documents hovers around $10,000 and requires the services of a surveyor and experienced attorney.

If a homeowner is not ready to execute these plans right away, that is OK. They can stop at the recording step and would be grandfathered in to execute these plans in the future even if the municipality changes its building requirements down the road. Of course, many more details are involved, and hiring experts to help navigate the creation of these documents and development is key. Some homeowners are taking the step to create a condominium on their property to expand profitability when they go to sell, and some want to create multi-generational housing options for their families.

The point of this information is to elevate the awareness around these housing options and for homeowners to understand how to maximize the potential of their asset. It should also provide hope for some home buyers who think they are priced out of the market knowing that more of these housing opportunities are coming. If you are curious or have specific questions related to middle housing, please reach out. I have access to experts in the field who I can connect you with, so you can obtain accurate information. As always, it is my goal to help keep my clients well-informed and empower strong decisions.

QUARTERLY REPORTS Q2 2024

Home values had positive growth in the second quarter of 2024, and inched close to the peak levels we saw in Q2 2022 before the post-pandemic housing correction. Despite inflation and interest rates remaining stubborn, demand has continued to be strong, resulting in a seller’s market.

A bright light for buyers is the recent uptick in new listings, which has opened up more opportunities after starting the year with minimal selection. Additional inventory will cause home prices to stabilize after rapid growth over the last six months. The average homeowner has close to 60% in home equity resulting in great returns when making a sale.

If you are curious about how today’s market relates to your real estate goals, please reach out. It is my goal to educate, inform, and empower strong decisions.

Half Way Through 2024: Mid-Year Opportunities in the Real Estate Market

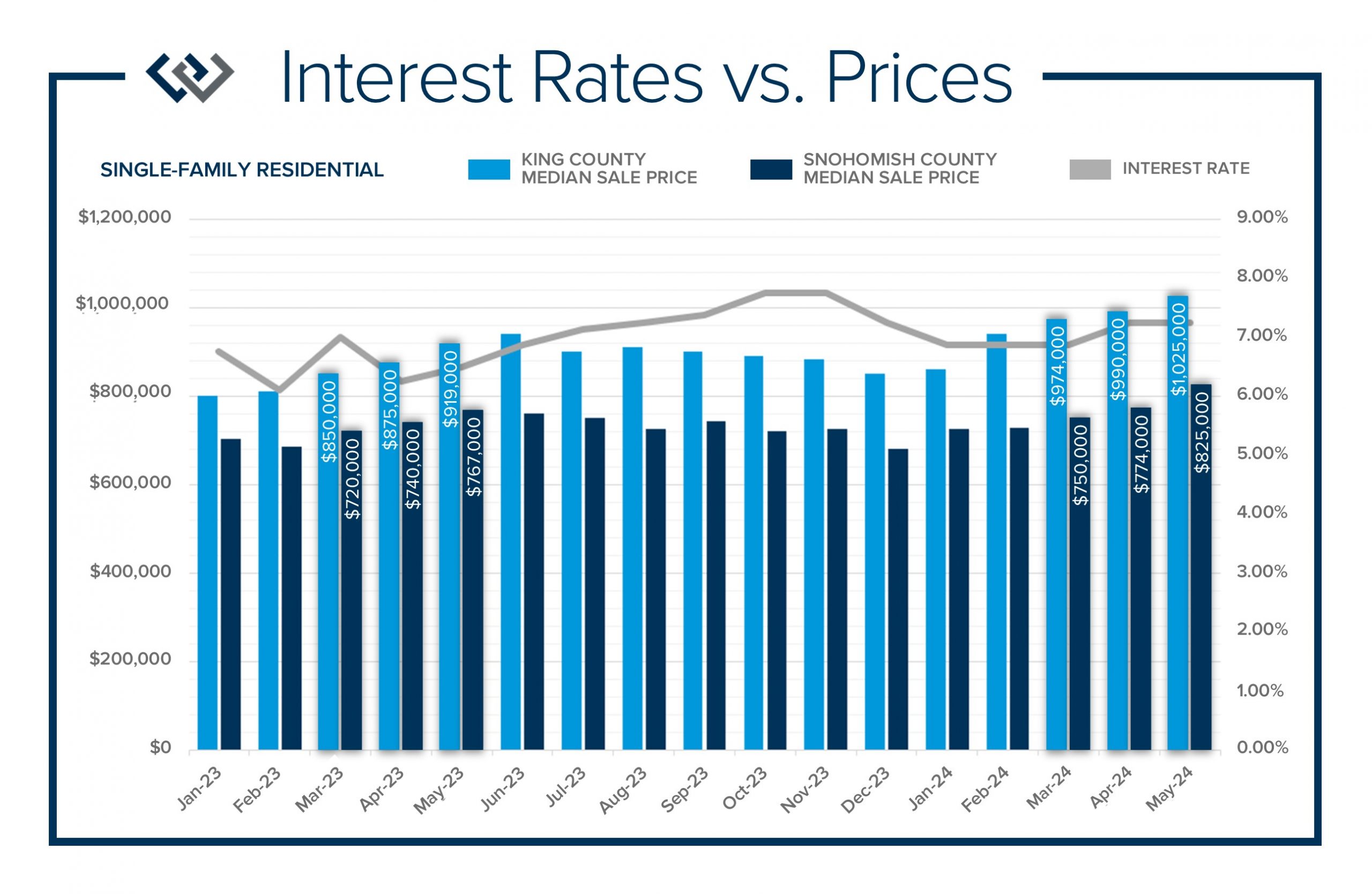

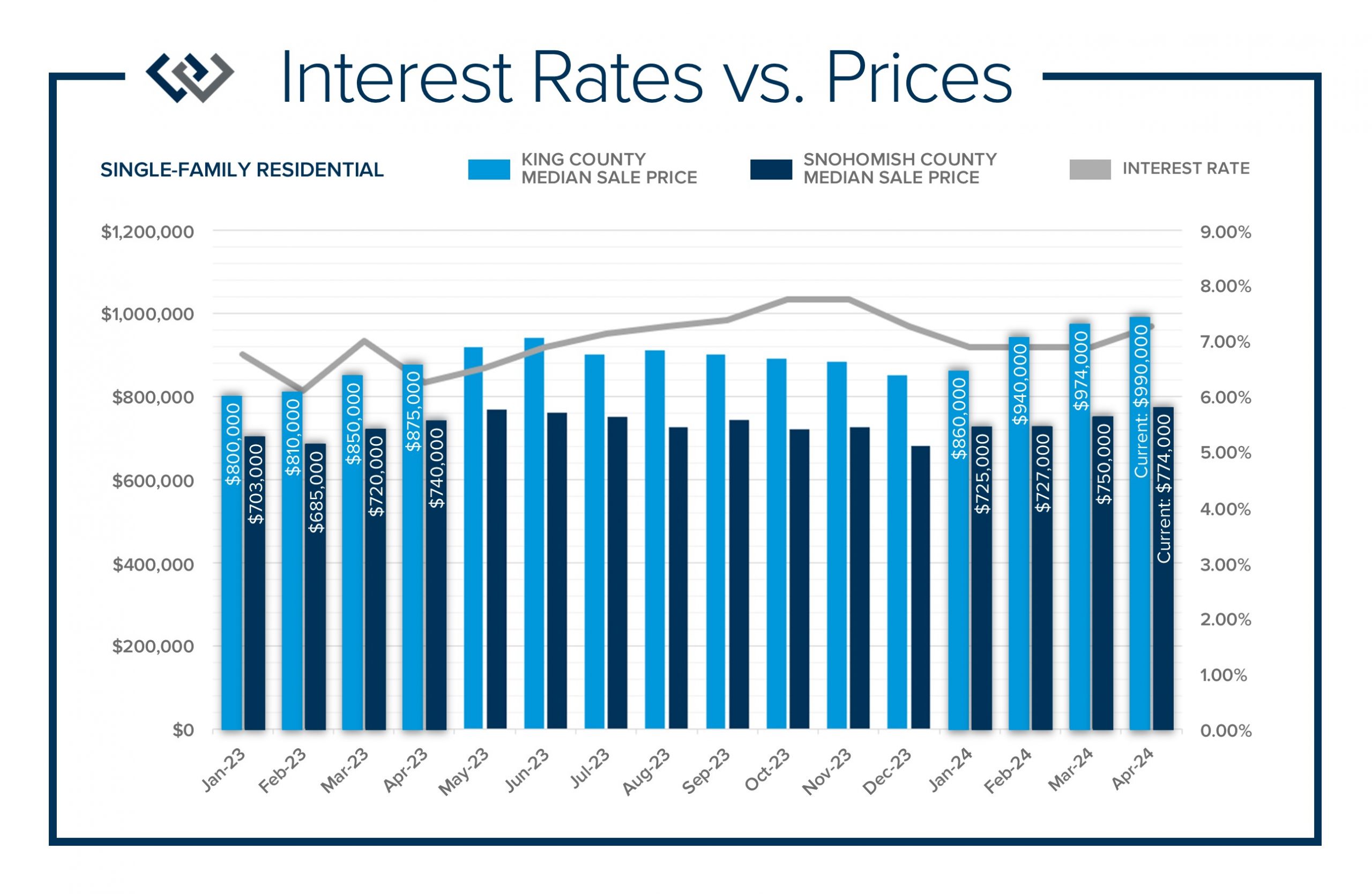

As we approach the mid-point of the year, I want to take a moment to explain all that has happened in the 2024 real estate market and where we might be headed. We have had strong price growth since December 2023, and in May 2024 prices matched the peak we saw in spring 2022. The interest rate increase and inflation-induced correction that took place in the spring of 2022 has shown very strong signs of recovery and stabilization. The chart below shows the last 17 months of median prices in both King and Snohomish Counties and also tracks the ebb and flow of interest rates.

Despite interest rates fluctuating between 6.75-7.5% from January through May 2024, price growth has been on an upward trajectory. Most recently, rates have hovered close to 7%. Inventory started the year very low! In King County, there were only 1,324 new listings in January and 534 in Snohomish County. This trend continued throughout Q1 2024 and has started to increase in Q2. In May 2024 there were 3,245 new listings in King County and 1,272 in Snohomish County. That was a 145% increase in King County from January to May and 138% in Snohomish County. Markedly, there was a 27% jump in new listings from April 2024 to May 2024 in King County and 34% in Snohomish County.

Adequate selection for buyers was limited, which drove prices up over the past five months. Buyers are starting to see some relief! There is healthy net in-migration into the Greater Seattle area, a stable job market, and the Millennial generation is out in force making their first purchases and some even moving up from their first homes. Since December 2023, the median price in King and Snohomish Counties has increased by 21%. One must take seasonality into account which elevates that growth, but there has certainly been a recovery in home values in the correction. Sellers are sitting on tons of equity as it was measured in November 2023 that homeowners in King County had at least 60% home equity and 57.5% in Snohomish County. This figure does not take into account the price growth we have seen in 2024 thus far.

So, what does all of this mean going forward? We typically will reach our seasonal peak in prices in May or June. This phenomenon is a result of price growth decelerating due to inventory growth over the second half of the year. The rate of price growth will slow as more homes come to market; this is not price depreciation, but deceleration. Homeowners are standing on the shoulders of immense growth over the last 5 months and need to keep that and the long-term growth in perspective. If the rapid rate of price growth continued, it would not be sustainable and would create market volatility. Moderation and price stability benefit the overall health of the real estate market and economy over prolonged extreme price increases.

As we head into the summer months, I anticipate more selection for buyers which will temper price growth. Sellers will enjoy the gains that have been made over the last 2 years and so far in 2024, not to mention the last 10 years. The recent increase in inventory has given buyers more opportunities to make a move. The constriction we started the year off with was restrictive for some buyers to enter the market and we see that changing. Buyers who were discouraged earlier this year may consider re-engaging so they can benefit from the increase in selection.

As far as interest rates, experts predict they will slowly recede and be dependent on inflation calming which has been stubborn. Affordability has been a dance of balancing home prices, rates, and monthly payments. Some buyers have been creative with rate buy-downs to manage the monthly expense, and some are purchasing based on today’s rates with the hope of re-financing in the future. A sound piece of advice for buyers is to buy based on payment, not on the peak of what you can qualify for. Your monthly output needs to be sustainable and somewhat comfortable to make sense.

Real estate is an investment and a key component to building wealth. While it might seem scary or risky to make a purchase, the long-term gains are favorable in comparison to other investment vehicles. Plus, you get to live in your home, love your home, and make memories in your home while it creates a nest egg. Life changes create reasons to move. Assessing where you want to be and how it matches your lifestyle is where the decision-making starts. If you have experienced some life changes and are curious about how the market relates to your housing goals, please reach out. It is my goal to help keep my clients informed and empower strong decisions.

Transparency First: NWMLS Votes to NOT opt in to the NAR Lawsuit Settlement

As promised, here is the latest update regarding the $418 Million NAR Lawsuit Settlement and how it will affect real estate operations in WA State. As the deadline to opt in to the NAR Lawsuit Settlement approaches, the Northwest Multiple Listing Service (NWMLS) announced last week that they have voted to NOT opt-in to the settlement.

The NWMLS is a member-owned organization that serves over 35,000 brokers in WA State where 26 of the 39 counties in WA, including Snohomish, King, Skagit, Kitsap, Whatcom, and Pierce counties share their listings. Unlike many MLSs across the country, the NWMLS is not owned by the National Association of Realtors (NAR), giving them a choice to opt in to the lawsuit settlement which would require payment and adhering to specific business practices. With transparency a proven cornerstone of their mission, the NWMLS felt secure and confident in the structure and processes they have in place. Their intent has always been to elevate consumer protection and provide an open and fair marketplace, which led to the decision to not opt in to the settlement agreement.

Besides payment, there are 4 major mandates resulting from the settlement agreement that NAR-owned MLSs and non-NAR MLSs that opt in will be required to adapt to in August 2024.

- The requirement to provide Buyer Brokerage Compensation (BBC) in all listings will be removed.

- Brokers will be required to enter into a written Buyer Agency Agreement (BAA) with Buyers which clearly outlines compensation before rendering Buyer Brokerage Services.

- Listing Agreements will de-couple the listing brokerage compensation from the buyer brokerage compensation, outlining clear and separate offerings of compensation for each side of a transaction.

- MLSs will be prohibited from publishing offers of buyer brokerage compensation.

The majority of the requirements mandated by the settlement had already been established by the NWMLS. In 2019, the NWMLS removed the BBC requirement and started to syndicate the published BBCs to third-party sites, such as Zillow, for full consumer transparency. In 2022, the listing agreement was amended to reflect de-coupled compensation and the BBC was added to the front page of the Purchase and Sale Agreement (PSA). In Jan 2024, WA State law was put into place requiring all brokers to enter into BAAs, which are called Buyer Brokerage Service Agreements (BBSAs) in WA. This legislative change was enacted with support from the NWMLS who advocated for the new laws and they re-built their forms to support this elevated level of transparency.

The NWMLS was able to choose to opt in, which would require payment towards the settlement and adhering to the fourth process change of removing published BBC from listings on the database. Due to the NWMLS’s historical innovation and leadership surrounding representation, compensation, and transparency, which has been an example for the rest of the country, they voted to not opt-in. In fact, they concluded that not publishing an offered BBC, whether the offering is zero, a flat rate, or a percentage, would reduce consumer transparency.

Further, not publishing what a seller is offering or not offering, could lead to deceptive practices that could harm consumers. The NWMLS shared this in their press release announcing their decision.

“NWMLS will not “opt-in” to NAR’s proposed settlement agreement. NWMLS’s rules and forms, together with the revised Agency Law, provide for consumer-friendly brokerage relationships. Sellers negotiate how much to compensate the listing firm and decide whether to offer to contribute toward the buyer’s broker compensation and the amount of any such offer. Buyers agree how much to pay their own brokers at the outset of their relationship, and can then negotiate for the seller to help cover that cost as part of the purchase.

NAR’s proposed settlement agreement largely duplicates the rules and practices in place in NWMLS’s service area for several years – with one notable exception. The settlement agreement eliminates compensation transparency for buyers and restrains sellers’ choice by prohibiting sellers from making offers of compensation through the MLS. Instead, the settlement agreement allows for offers of compensation “off MLS”, where that information is hard to find and not available to all buyers and brokers. That change is a step in the wrong direction and is detrimental to consumers and brokers alike.

NWMLS strives to provide consumers with all relevant information about a listed property to promote efficiency, competition, and an open and free market. NWMLS’s rules and forms broaden, not limit, consumer choice and do not favor any brokerage service model or compensation structure. NWMLS allows the market to operate unimpeded by MLS rules.

NAR’s removal of compensation transparency from the MLS pushes consumers and brokers to make secret deals “off-MLS”, inviting deceptive practices, discrimination, and unfair housing. Depriving buyers of information about the transaction risks harming buyers, especially those buyers who are already disadvantaged, including first-time home buyers and members of protected classes. Of course, prohibiting offers of compensation in the MLS also unnecessarily restrains the seller’s choice and absolute right to offer compensation to a brokerage firm representing the buyer.”

As I move forward in my business practices and adhere to the NWMLS leadership, I am proud to be a broker in WA State. Our corner of the world has put great thought, effort, and execution towards elevating the consumer experience in a real estate transaction. We have navigated changes, tackled open communication head-on, and strive to bring value to the consumer at every turn. This lawsuit has created a lot of noise and confusion; it is important to understand how WA stands out from the rest of the nation.

As headlines soar and the media bends the narrative, you can count on me to help keep you informed so you can accurately grasp how the progression of the industry affects you. I am happy to report that how we are conducting business here will be in line with the innovation that the NWMLS already has in place. We will watch the rest of the country catch up and proudly lead that charge. Stepping out in front seemed bold at first, and has proven to be the right course of action. Due to the insightful, considerate, and thoughtful guidance of the NWMLS, we will continue to prioritize full transparency and be able to focus on providing the best service possible for our clients.

If you have any additional questions or want to discuss this topic, please reach out. It is always my goal to help keep my clients well-informed and empower strong decisions. Here’s to moving forward with excellent practices in place to help consumers safely and securely buy and sell property.

Buyer Demand Persists and Seller Equity Soars Amongst Interest Rate Volatility

As we sit almost five months into 2024 in the middle of the spring market and I reflect on how the year is going, I am grateful, amazed, and locked in on the stats. You see, the last four years since the start of the pandemic have been an eventful and wild ride. 2020 saw a brief halt in sales when the shelter-in-place order went into effect, and once protocols were established to make real estate essential, the market started to take off. Many people utilized that time to re-evaluate where they wanted to live, whether that meant in a different state, from an urban location to a rural setting, or from a shared condo building to a single-family residential house.

This re-organization of where people wanted to live was coupled with historically low interest rates that hovered in the 3% range, leading to the highest number of recorded closed sales in 2020 and 2021 that we had seen in over a decade. All of this activity took place while inflation was on a stubborn uphill trajectory, causing the Fed to make some big rate increases to help combat consumer spending in 2022.

Rates increased by three percentage points from February 2022 (3.9%) to October 2022 (7%) and have remained in that higher range ever since. This quickly put a stall on buyer demand as monthly payments quickly became more expensive, putting downward pressure on affordability. This caused a correction in prices from the peak in spring 2022 to the first quarter of 2023 when prices bottomed out.

In King County, prices corrected from the peak to the bottom by 20%, and in Snohomish County, 17%. Prices started to bounce back from the bottoming out in the spring of 2023, and since then have increased 24% in King County and 13% in Snohomish County. While prices were stabilizing and then growing from Q1 2023 until now, interest rates have hovered in the 7% range. Buyer demand slowly regained its footing throughout 2023 and when the calendar turned to 2024, buyers started to come out in force despite the interest rates never returning to historic lows. It is safe to say that many buyers have accepted the higher interest rates as the new normal.

In this new normal, monthly payments are high as prices remain stable and have had extreme appreciation since the start of 2024. In King County, prices have grown by 16% from Dec 2023 to April 2024 and in Snohomish County by 14%. At the end of 2023, it was reported that the average homeowner had at least 60% home equity in King County and 57.5% in Snohomish County. That equity measurement doesn’t include the price growth we have experienced so far in 2024.

Rates have remained stubborn due to inflation still being a challenge. Inflation has tempered, but not to the 2% year-over-year level the Fed wants to see before easing interest rates. The Fed met at the beginning of May and indicated that rates will slowly come down in the second half of 2024 and into 2025 if inflation rates reach that 2% year-over-year mark. That will be a key marker to track as the Fed Chairman, Jerome Powell has made it clear that will be what it takes to cause rate relief.

Some buyers may wait to enter the market once rates have eased, and many are jumping in now as they are happy to secure today’s prices. Demand will only increase when rates improve, which should most likely cause additional price growth. Creative financing options such as interest rate buy-downs and ARM (Adjustable-Rate Mortgage) loans have helped buyers manage their monthly payments when making a purchase. The key factor I help the buyers I serve stay focused on, is the affordability of their monthly payments.

This focus has proven to be the most productive and strategic number to stay connected with to help a buyer remain confident and effective. Buyers often make adjustments in price point, features, and/or location to match up a manageable monthly payment with the home they buy. Analyzing the trends, stats, and values from one area to the next is an exercise that helps buyers gain clarity. We often say that when a buyer finds a home that matches 75-85% of their criteria they are in striking distance to make an offer. In a seller’s market like this, buyers must make compromises to succeed.

A bright light for buyers is that we have seen a recent jump in new listings. There were 30% more new listings in April 2024 over April 2023 in King County and 32% more in Snohomish County. With seller equity so high and pent-up seller motivation boiling over, we are finally starting to see additional inventory come to market. We are still experiencing tight inventory, but it is growing. This is providing some additional selection and should hopefully continue throughout 2024.

Continuing my daily, weekly, monthly, and annual commitment to studying the market is a benefit to the clients I serve. Understanding how inventory, rates, and prices all relate to each other helps me provide valuable insights for clients so they can appropriately strategize when they want to enter the market. These trends vary from one city to the next, in different price points and property types. If you are curious about how today’s trends relate to your real estate goals, please reach out. Further, if you know someone who needs my assistance, please direct them my way. It is my goal to help keep my clients well-informed to empower strong decisions.

Three Hot Buttons in Real Estate

The real estate industry has been in the news a bit lately. Not so much about the trends and home values. More so about class action lawsuits, which have stolen a lot of attention away from the positive activity that is happening in our market. While the lawsuit is an important story to track, one critical item to mention is that WA has already complied with the majority of what the proposed lawsuit settlement is suggesting.

New laws went into place on Jan 1, 2024, that complemented changes our MLS started making in 2019. We have been smooth sailing for almost four months bringing heightened transparency to every real estate transaction we do with new laws, forms, and procedures. The national hype has caused a stir, so before I get into the three important trends, I wanted to let you know that WA is ahead of the curve. If you have any questions on how to distinguish the national headlines from the local truth, please don’t hesitate to contact me.

INFLATION: Interest Rates & Insurance

Inflation has been a hot topic for a few years now. We all know the cost of groceries, gas, and everyday items are higher than they were just a few years ago. This caused interest rates to increase in spring 2022, hovering between 6.25-7.5% over the last 2 years. Despite these rate increases we have watched the real estate market and home values recover and start to appreciate again. The median price in Snohomish County is up 5% in Q1 2024 over Q1 2023 and up 13% in King County. The spring market has sprung!

The lending costs to purchase a home have increased and it has limited and sidelined some buyers. However, many are finding ways to make it work and demand is strong with the return of multiple offers and price escalations on well-priced and presented listings. If you are waiting for rates to come down, also pay attention to prices as it is a delicate balance of affordability. The option to re-finance your interest rate down the road if rates dip will decrease your monthly payment while keeping your loan balance fixed.

Homeowners Insurance has also been hit hard by inflation and a heightened amount of claims over the last four years. Natural disasters such as fires, floods, and earthquakes have depleted many insurance companies’ reserves causing them to re-calibrate their rates across the board to keep up. You may have seen an increase in your rate. With home values and goods on the rise, it is important that you have your home and belongings adequately insured.

I’d suggest you check in with your carrier to make sure they have your home and your belongings properly valued. With market dynamics quickly shifting I’d caution you from grabbing your home value from an online estimator such as Zillow or your insurer’s automated program. Those algorithms are most often inaccurate which could leave you under-insured. I’m happy to help you assess the current value of your home in today’s market so you can properly calibrate your homeowner’s insurance in this volatile insurance environment.

HOME EQUITY Movement:

According to ATTOM data, 67.4% of homeowners in the U.S. have at least 50% home equity, with 38.7% owning their homes free and clear. Locally, the average homeowner in Snohomish County has 57.5% home equity, and in King County 60%. Those local figures were reported in Q4 2023 and we have seen a jump in values since then indicating that those figures are now higher.

The point is that home equity is strong for many homeowners, which allows homeowners who are looking to make a move to use creative options to make those moves smooth. We are in a competitive seller’s market so trying to purchase a home contingent on the sale of your current home is a challenging feat. At Windermere, we have the awesome Windermere Bridge Loan Program (WBLP) that helps people tap into their equity to make their next purchase instead of having to sell their homes first.

The WBLP does not require an appraisal like a Home Equity Line of Credit (HELOC), is quickly approved, and does not require monthly payments. The loan balance and any accrued interest are paid off when the collateral property is sold, allowing buyers who are also sellers to easily utilize their equity and not have to move twice. I’ve even seen the collateral property close first if strategized properly. This eliminates having to fund the Bridge Loan altogether, yet it was used to make that buyer’s offer competitive and helped them win the house for their next chapter in life.

HOME PREPARATION Overwhelm:

One of the biggest tasks I assist clients with is preparing their homes for the market. How a home comes to market can make a huge difference in the bottom line. Remedying deferred maintenance, making home improvements, remodeling, clean-up, purging, and merchandising can all contribute to a seller making more money on closing day. Creating a punch list of items that will create the most favorable return is a service I provide my clients.

Identifying the available funds, hiring service providers, and just getting started can cause overwhelm and sometimes paralysis. As stated above, many homeowners have amazing home equity. Leveraging home equity can help a homeowner complete the projects that will make a better profit! At Windermere, we have the Windermere Ready Program (WRP) which allows home sellers to tap into their equity before coming to market to get their homes market-ready.

Like the WBLP, the WRP is quickly approved, does not require an appraisal, and monthly payments are not required. We figure out which projects we want to focus on, gather bids from trusted contractors, create a budget, and apply. The funds are provided within 2 weeks and we can line up the work and start the transformation immediately.

I’ve seen simple flooring replacements and fresh paint transform a house. We’ve even done a full kitchen remodel to completely change up the vibe. The projects that warm my heart are helping elderly sellers sort through years of living and clearing the space for potential buyers to envision themselves in the home. Did you know that there are companies that help people sort and purge their belongings, so they are prepared to move on to their next chapter? Lastly, we can solve property issues with the WRP! Earlier this year, we discovered a failed septic system on a listing and we were able to utilize the WRP to tackle that fix and made it to the closing table at top dollar.

Markets are fast-paced and dynamic! Helping clients navigate the environment to protect their investment, strategize financing, and/or prepare their property are tasks that I take very seriously. Even if it is as simple or complicated as clearing a house for the market. Whether we are evaluating these items for an immediate move or we are planning out years in the future providing this care matters to me! Please reach out if you or someone you know are curious about how the trends relate to their situation. It is my mission to help keep my clients well informed to empower strong decisions.

QUARTERLY REPORTS Q1 2024

After an almost two-year journey of recovery and stabilization since the spring 2022 correction, the market has started to experience solid price appreciation. The median price in Q1 2024 vs. Q1 2023 shows that despite interest rates remaining stubborn, buyer demand is returning to the market. Improved consumer confidence and acclimation to lending costs have caused price growth, especially amongst tight inventory levels.

New listings are slowly increasing over 2023 as pent-up seller demand meets the market. Equity levels across our region are strong, providing favorable returns for home sellers. Many experts predict interest rates to gradually fall in 2024, estimating they will reach the mid to lower 6% range later this year. While the cost of lending still has some buyers sidelined, many are forging ahead now.

Life changes often determine a move. It is my goal to help empower strong decisions by assessing my client’s lifestyle and financial goals amidst real-time market trends and conditions. Whether you have considered selling, buying, or both, or you’re just curious about the market, please reach out.

Accurate Update: Washington State & the Proposed NAR Settlement

As I am sure you have heard on the news, there is a proposed settlement agreement for the NAR (National Association of Realtors) Class Action Lawsuit. It has certainly stirred up plenty of headlines that have been glossy, and in many cases, inaccurate. Many of the reports and headlines have been national and it is important to note that WA state is unique and could have far fewer changes than the rest of the country if the settlement is approved.

The majority of the MLSs (Multiple Listing Services) across the country are owned by NAR and our NWMLS (Northwest Multiple Listing Service) in WA, is not. NWMLS is not included in the settlement agreement as they are not NAR-owned. If the settlement is approved, they can choose to opt in, which is undecided at this point as it will require a vote of their board of directors.

In WA, new laws were enacted on January 1, 2024 that address many aspects that the settlement agreement is proposing. For years, WA brokers and NWMLS have been committed to elevating transparency around broker compensation, resulting in brokers in WA already doing business as many of the new proposals in the settlement agreement suggest. You can refer to the newsletter I published in early February that outlines the new laws that went into place on Jan 1. I am also happy to report that practicing under these new laws has been positive and productive for consumers and brokers alike.

The proposed settlement agreement still needs to be approved by the court. Once that is done, I will report back to explain how it will affect real estate operations in WA state. In the meantime, I also want to report that market activity in Q1 2024 has been positive!

Price growth is up, buyer demand is strong, and inventory remains low. Seller equity is soaring, with home equity in King County averaging 60% and 57.5% in Snohomish County. These figures were reported in December 2023 and don’t account for the price growth we’ve seen in Q1. Interest rates are still hovering around the high 6% and are predicted to come down this year, yet remain volatile and stubborn. Please reach out if you or someone you know would like to learn more. It is always my goal to help keep my clients informed and empower strong decisions.

Phill was Right! Spring Arrives Early for our Local Real Estate Market

When Punxsutawney Phill climbed up to his perch at Gobblers Knob on February 2nd and did not see his shadow, an early spring was predicted. Little did we know that he would be referring to the real estate market! As we experience temps in the 30s and scattered snow showers in the first week of March, we are also experiencing a white-hot seller’s market.

We started 2024 with the lowest amount of inventory we have seen since the beginning of 2022. Over the last 2 years, we have experienced a correction and recovery in the real estate market due to inflation and interest rates. The market peaked in April 2022 in Snohomish County when the median price reached $830,000, and in May 2022 in King County when prices reached $1M. Prices started to correct when rates crested 5% in April 2022 and then found themselves squarely at 7% by October 2022. This rapid 2-point increase put downward pressure on prices and stalled buyer and seller demand.

Loan servicing affordability caused prices to bottom out in Snohomish County in February 2023 at $685,000, and in King County in January 2023 at $800,000. The bulk of the correction took place in 2022, and 2023 was the year of resetting price stability and the return of appreciation. What was fascinating about this growth is that interest rates still averaged around 7% throughout 2023.

In Snohomish County prices were up 6% in February 2024 over February 2023, and in King County they were up 16%, and rates are still hanging around 7%. Since the first of the year, it was like a switch went off for many buyers and demand flooded the market. The feedback that I am hearing is that many buyers have adapted to the new normal of interest rates and will refinance when rates come down; but they want to buy now. The increase in buyer demand coupled with the lowest inventory we’ve seen in two years has caused a flurry of multiple offers, price escalations, and an early start to the spring market.

Now that we are certain buyers are back, the next effective change in the market would be the addition of more inventory. This would meet the demand and create more movement in the market. We are well aware that many homeowners are reluctant to make a move because they don’t want to give up their low rate/payment. We also know that because of this, many would-be sellers are living in homes that do not match their needs and wants.

This pent-up seller demand is starting to come to market, but more is needed. The average level of equity in Snohomish County was reported at the end of 2023 at 57.5% and in King County at 60%. With the recent uptick in median price, this level is growing, which will allow many sellers to move their equity into a home that better fits their lifestyle. This growth should also be supported by interest rates slowly coming down throughout 2024.

The latest predictions from the Home Price Expectation Survey (HPES) have rates decreasing to 6% by the end of 2024 which will only add to buyer demand, highlighting the need for more listings. If you are a homeowner and your house is not matching your life, now might be the time to consider a move! What has already transpired in the first 2 months of 2024 has been encouraging for seller gains.

Writing a playbook and creating a strategy to make these transitions requires a well-curated plan. It is my mission and passion to help clients make these moves. There can be challenges to overcome along the way, such as does one sell or buy first and how to do you get your home ready for market. Tools such as the Windermere Bridge Loan, The Windermere Ready Loan, and other alternative financing have helped make these dreams become a reality. That is why hiring a professional who is well-versed in market knowledge, creative planning, expert marketing, and keen negotiations is key!

Please reach out if you or someone you know is curious about the market and how it relates to your financial and lifestyle goals. Real estate reflects life and if there is one constant in life, it is change! Helping people match their homes to their lives is one of the most rewarding aspects of my job. The adjustments over the past two years got in the way of many people making those matches. As the market and consumer confidence continue to open up, don’t let this opportunity pass you by. It is my goal to help keep my clients well-informed and empower strong decisions whether that works for you now or sometime down the road. Let’s talk it out, dig deep into the trends, and start your strategic planning with no pressure.

New Year, New Laws! What This Means for Consumers Moving Forward.

Effective January 1, 2024, the statute in Washington that governs real estate brokerage relationships (RCW 18.86) otherwise known as the “Agency Law” – was significantly revised. The revisions modernize the 25-year-old law, provide additional transparency and consumer protections, and acknowledge the importance of buyer representation.

KEY REVISIONS

For decades, real estate brokerage firms were only required to enter into written agency agreements with sellers, not buyers. The Agency Law now requires firms to enter into a written “brokerage services agreement” (agency agreements) with any party the firm represents, both sellers and buyers.

This change is to ensure that buyers (in addition to sellers) clearly understand the terms of the firm’s representation and compensation, much like a listing agreement. The new agreements are called Buyer Brokerage Service Agreements (BBSA) and they are to be initiated in writing prior to or upon rendering real estate brokerage services, such as showing homes.

The services agreement with buyers must include:

- The term of the agreement (with a default term of 60 days and an option for a longer term);

- The name of the broker appointed to be the buyer’s agent;

- Whether the agency relationship is exclusive or non-exclusive;

- Whether the buyer consents to the individual broker representing both the buyer and the seller in the same transaction (referred to as “limited dual agency”);

- Whether the buyer consents to the broker’s designated broker/managing broker’s limited dual agency;

- The amount the firm will be compensated and who will pay the compensation; and

- Any other agreements between the parties.

Clearly communicated expectations between the buyer and their broker are an advantage to the buyer. Every party deserves representation and it has been a long time coming for the law to pay as much attention to buyers as it has to sellers. Having competent representation on both sides of a transaction makes the process go smoother and reduces liability during and after the transaction. After all, everyone deserves competent representation during one of the biggest transactions they will partake in.

These changes are intended to elevate transparency in agency relationships for the consumer and encourage more detailed conversations about representation, compensation, and the overall home buying process with the broker they chose to align with. This will also cause sellers to gain a better understanding of how buyer brokers are compensated.

What a seller chooses to offer a buyer broker could have a positive effect on their return. The only way a buyer can compensate their broker is with liquid cash or negotiating with the seller within the purchase and sale agreement when their BBSA doesn’t match the seller-offered compensation for the buyer broker. If their BBSA matches what the seller is offering in the listing for the buyer broker compensation, then the buyer does not have to rely on the prior.

Compensation offered in a listing that mirrors the BBSA will allow a buyer to solely focus on the offer price of the home as they will not have to calculate the math of the compensation against their down-payment funds, as lending regulations do not allow for broker compensation to be financed. If a buyer has to set aside funds for compensation it would likely reduce their down payment amount which would increase their monthly payment and make them more price sensitive. It will also eliminate the compounding effect of compensation and the offer price being simultaneously negotiated.

I have always run my business in a very detailed fashion and pride myself on having a deep knowledge of the laws and the forms, and these changes are paramount. As an independent contractor affiliated with Windermere Real Estate, the leading company in our region, it is up to me to dig into the research and gain understanding to help guide my clients through these advancements in a compliant and service-oriented fashion. There are even aspects of these new laws that I have been practicing before the changes, as transparency is a cornerstone of my value to my clients.

These are the biggest changes we have seen in our industry in over two decades. Be aware that not all brokers will adapt as quickly or accurately. We are already seeing a gross difference between the informed and not informed; who one chooses to work with matters! If you have any further questions about how these new laws affect you, please reach out. If you are considering a move, I am committed to navigating the process with the utmost compliance and my client’s success at the forefront.

REVISED PAMPHLET: The pamphlet entitled “Real Estate Brokerage in Washington” provides an overview of the revised Agency Law.

REVISED AGENCY LAW: Substitute Senate Bill 5191 sets forth the revised Agency Law in its entirety.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link