December is for GIVING at Windermere North!

Between holiday parties, family obligations, work, and the pressure of finding the perfect gift, this time of year can come and go in a flash. At Windermere North, we never want this season to go by without coming together to lift up our community and give back in meaningful ways.

Between holiday parties, family obligations, work, and the pressure of finding the perfect gift, this time of year can come and go in a flash. At Windermere North, we never want this season to go by without coming together to lift up our community and give back in meaningful ways.

Our office-wide annual holiday giving project is in two parts. First, all the brokers in my office joined together to provide $4,242 in grocery gift cards for 16 families, comprised of 48 individuals. Some of these families are dealing with grief and loss this season, some are coming out of domestic violence, some are homeless or unemployed. It is our privilege to partner with Pioneer Human Services for this every year, to help lift some of the burdens for these families.

We also had the joy of helping to bring some holiday cheer for homeless youth in our area. We partnered with WA Kids in Transition who works with social workers in Edmonds School District schools to collect wish lists from homeless students living in shelters, tents, cars, transitional housing or other temporary housing. We fulfilled the wish lists for 14 kids, plus several hygiene kits.

The other Windermere North holiday giving tradition that I love, is volunteering at Christmas House in Everett. Christmas House is a 100% volunteer, non-profit organization that provides an opportunity for qualifying, low-income, Snohomish County parents to select free holiday gifts for their children age infant-18. This is an amazing day helping families in need have a joyful Christmas.

What better way to celebrate Windermere’s 50th anniversary than reaching $50 million in total donations to the Windermere Foundation? Windermere offices across the Western U.S. came together to raise over $4 million this year for low-income and homeless families! Thank you to everyone who helped us get here by giving their time and donating funds. To our clients: a portion of every home sold or purchased goes to the Windermere Foundation, so we couldn’t have done it without you. Here’s to $50 million raised!

Are you curious about the economy during these changing times?

Are you trying to make plans, but crave credible information to assist you?

Please join me for a very special virtual live event:

AN ECONOMIC FORECAST FOR 2023 & BEYOND

with Matthew Gardner, Chief Economist for Windermere Real Estate

Wednesday, January 18, 2023 • 6:30pm – 8pm

Presentation from 6:30-7:30pm, Q&A to follow

Please RSVP by phone/text or email by January 13th, 2023 to receive an emailed link prior to the event.

Key Factors to Note as the Market Recalibrates in the New Year

2022 has been an eventful year in the real estate market and the economy. After 2 years of pandemic-fueled demand and historically low interest rates, we experienced a shift. The Fed quickly raised rates (by 2 points) from April to October to combat inflation, curbing buyer demand as affordability took a hit. The overall economy is starting to settle back to pre-pandemic levels and the second half of 2022 was the time that was needed to make this adjustment.

We have recently seen rates drop as year-over-year inflation numbers start to show improvement. We anticipate this trend to continue slowly but surely as we head into 2023 and beyond. The upward trend in rates has put downward pressure on prices, but they are starting to stabilize as the new normal sets in. Price appreciation is still up year-over-year when you look at the average of the last 12 months and compare them to the previous 12 months, and certainly over the last 3-10 years as a whole.

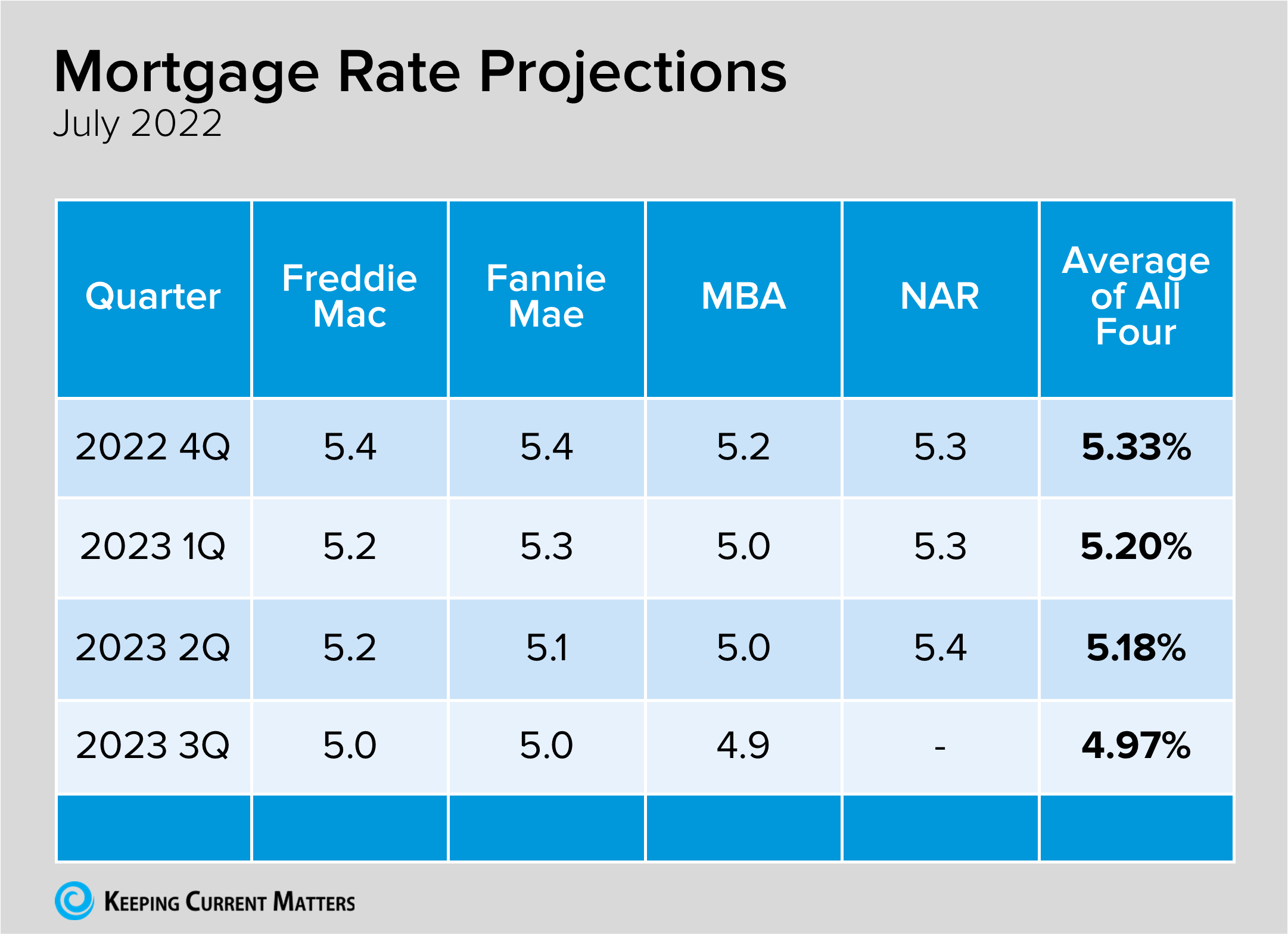

We started 2022 at 3.5%, peaked at just over 7%, and now find rates in the mid-6%. Experts like Matthew Gardner are anticipating rates to settle in the high 5% sometime in 2023, which would be 2 points below the historical average. Currently, buyers are enjoying more favorable negotiations and are securing sale prices that are not escalating at a feverish pitch.

Some buyers are getting creative and using seller credits for a rate buy-down, some are securing adjustable-rate mortgages, and some just plan to re-finance when rates come down further next year. It is important for buyers to understand that as rates come down prices will start to fortify again.

Besides rates and prices, which are related, two additional factors to pay attention to are our local job market and estimating the recession. We have recently experienced some layoffs in our region, particularly in the tech sector. See the video from Matthew Gardner here which speaks to this. The bottom line is over 20,000 jobs were added in the information sector during the pandemic, and that number is now receding. Just like prices grew exponentially during the pandemic, so did many other aspects of the economy and everything is finding its equilibrium as we return to our new normal. Bear in mind, there are other sectors of our local job market that are growing.

Besides rates and prices, which are related, two additional factors to pay attention to are our local job market and estimating the recession. We have recently experienced some layoffs in our region, particularly in the tech sector. See the video from Matthew Gardner here which speaks to this. The bottom line is over 20,000 jobs were added in the information sector during the pandemic, and that number is now receding. Just like prices grew exponentially during the pandemic, so did many other aspects of the economy and everything is finding its equilibrium as we return to our new normal. Bear in mind, there are other sectors of our local job market that are growing.

I’d like to leave you with two pieces of advice as we head into 2023 and are forced to jump on the media roller coaster of their reporting economic and real estate news. Pay attention to long-term figures and understand that real estate is a lifestyle move, not just a financial chess move.

The media will paint the picture that the sky is falling and it simply is not. The recession is predicted to be short, much like the recession of 1990-91. Some economists are claiming that we are already through the worst of it. This will be nothing like the Great Recession of 2007-2012, nothing! It just happens to be the one closest in our rear-view mirror and easiest to recall, but that was made up of entirely different factors that do not compare to our current environment. Please reach out if you’d like to further discuss the differences.

We are not headed toward a bubble in the real estate market. Homeowner equity is incredibly strong with over 50% of all homeowners in WA state having over 50% home equity. Homes are not foreclosed on when there is equity—period, end of story. As numbers are reported in the first half of 2023 they will be compared to the peak prices of 2022 and those numbers will create negative headlines. We will spend the first half of 2023 adjusting off of those peaks, but where I am sure the media will fall short is reporting the overall growth in values since 2019.

Real estate is a long-term hold investment, it always has been. The ramp-up of the pandemic years may have clouded that long-term truth, but I can assure you double-digit and certainly 20%+ annual appreciation is not normal. The historical norm is 3-5% annually.

For example, in Snohomish County when you take the last 12 months of median price and average it and compare it to the previous 12 months, prices are up 15%. When you take the median price in Nov 2022 and compare it to the median price in Nov 2021, prices are up 3%. Further, when you take the median price in Nov 2022 and compare it to the median price two years ago in Nov 2020, prices are up 22%. We are experiencing a correction off of the peak, not a tumbling of long-term values. Hence, why there is no bubble.

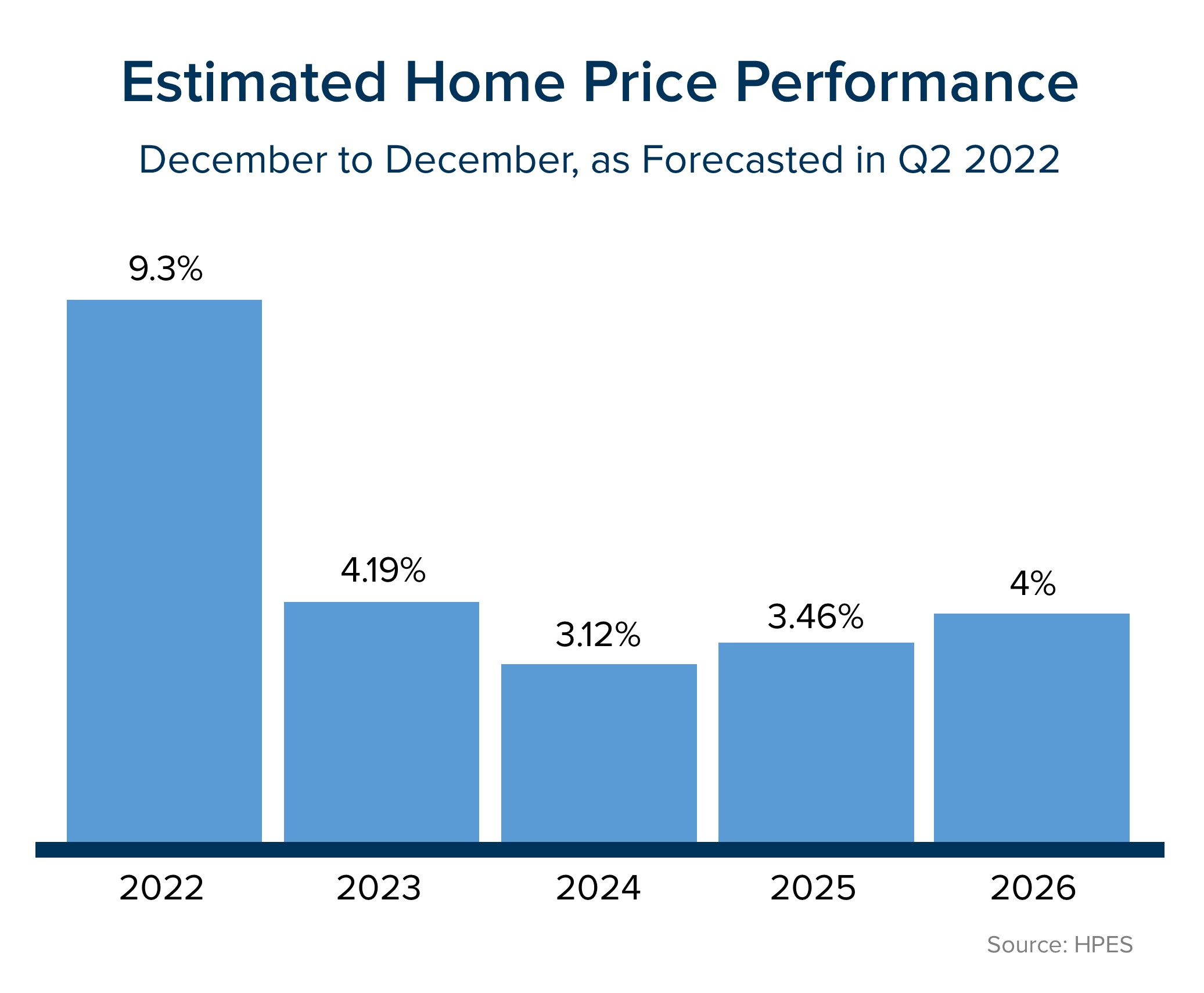

In fact, experts are anticipating that we end 2023 with positive, yet slight year-over-year appreciation. This is more reflective of historical norms and much calmer than the intense pandemic-fueled years that were inflated with rates that we will quite possibly never see again in our lifetime.

Lastly and most importantly, real estate moves are most often motivated by life changes. Job changes, familial changes, and financial shifts lead to people changing their housing and location. These big life changes are delicate and exciting, and require strategic planning and care. I am all about helping my clients obtain successful financial results, but I am also committed to helping my clients navigate the details, challenges, emotions, and logistics of a move. I always approach the process with the end in mind, but also with the journey prioritized to be smooth and enjoyable.

I hope you call on me when your curiosity is piqued or you have an emergent need in your world related to real estate. I take pride in understanding the latest trends and helping you apply them to your goals. Also, if you know of anyone that needs real estate help, please pass my name along or get me in touch with them. Your people are my people, and helping them stay well-informed to empower strong decisions is my mission. As we encounter change and recalibrate, this expertise will be more important than ever; I am honored to have your trust and endorsement.

Holiday Events = Holiday Giving

at Windermere North

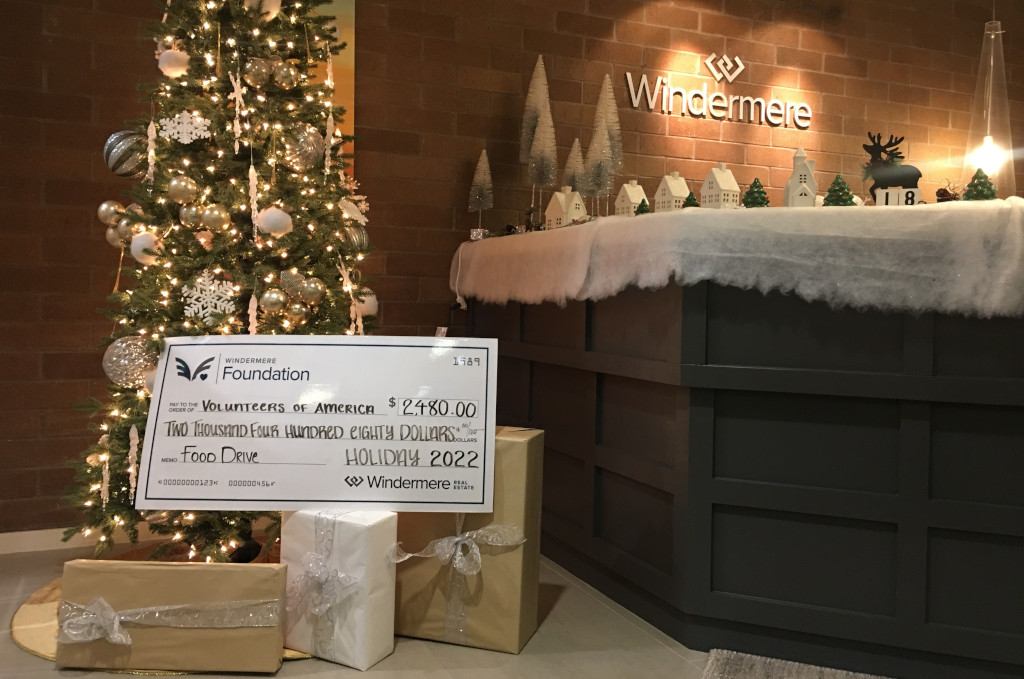

We have been busy at our office holding various holiday events that have included the opportunity to give back to the local food banks through holiday food drives. When we bring people together to celebrate it is also a priority to weave in giving back to our community. When we do this, we are always thrilled to partner with Volunteers of America of Snohomish County who support various food banks and food pantries across the county. Just this week, VOA picked up a total of 1,820 pounds of food and $2,480 that resulted from our holiday events.

With inflation still high, food insecurity is prevalent making these food drives an easy choice to direct our giving. If you are looking for a way to give back this holiday season, please reach out to VOA. They are a trusted local organization that will make sure your donation is placed to benefit those in need.

Matthew Gardner’s Top 10 Predictions for 2023

1 There Is No Housing Bubble

Mortgage rates rose steeply in 2022 which, when coupled with the massive run-up in home prices, has some suggesting that we are recreating the housing bubble of 2007. But that could not be further from the truth.

Over the past couple of years, home prices got ahead of themselves due to a perfect storm of massive pandemic-induced demand and historically low mortgage rates. While I expect year-over-year price declines in 2023, I don’t believe there will be a systemic drop in home values. Furthermore, as financing costs start to pull back in 2023, I expect that will allow prices to resume their long-term average pace of growth.

2 Mortgage Rates Will Drop

Mortgage rates started to skyrocket at the start of 2022 as the Federal Reserve announced their intent to address inflation. While the Fed doesn’t control mortgage rates, they can influence them, which we saw with the 30-year rate rising from 3.2% in early 2022 to over 7% by October.

Their efforts so far have yet to significantly reduce inflation, but they have increased the likelihood of a recession in 2023. Therefore, early in the year I expect the Fed to start pulling back from their aggressive policy stance, and this will allow rates to begin slowly stabilizing. Rates will remain above 6% until the fall of 2023 when they should dip into the high 5% range. While this is higher than we have become used to, it’s still more than 2% lower than the historic average.

3 Don’t Expect Inventory to Grow Significantly

Although inventory levels rose in 2022, they are still well below their long-term average. In 2023 I don’t expect a significant increase in the number of homes for sale, as many homeowners do not want to lose their low mortgage rate. In fact, I estimate that 25-30 million homeowners have mortgage rates around 3% or lower.

Of course, homes will be listed for sale for the usual reasons of career changes, death, and divorce, but the 2023 market will not have the normal turnover in housing that we have seen in recent years.

4 No Buyer’s Market But a More Balanced One

With supply levels expected to remain well below normal, it’s unlikely that we will see a buyer’s market in 2023. A buyer’s market is usually defined as having more than six months of available inventory, and the last time we reached that level was in 2012 when we were recovering from the housing bubble. To get to six months of inventory, we would have to reach two million listings, which hasn’t happened since 2015. In addition, monthly sales would have to drop below 325,000, a number we haven’t seen in over a decade. While a buyer’s market in 2023 is unlikely, I do expect a return to a far more balanced one.

5 Sellers Will Have to Become More Realistic

We all know that home sellers have had the upper hand for several years, but those days are behind us. That said, while the market has slowed, there are still buyers out there. The difference now is that higher mortgage rates and lower affordability are limiting how much buyers can pay for a home. Because of this, I expect listing prices to pull back further in the coming year, which will make accurate pricing more important than ever when selling a home.

6 Workers Return to Work (Sort of)

The pandemic’s impact on where many people could work was profound, as it allowed buyers to look further away from their workplaces and into more affordable markets. Many businesses are still determining their long-term work-from-home policies, but in the coming year I expect there will be more clarity for workers. This could be the catalyst for those who have been waiting to buy until they know how often they’re expected to work at the office.

7 New Construction Activity Is Unlikely to Increase

Permits for new home construction are down by over 17% year over year, as are new home starts. I predict that builders will pull back further in 2023, with new starts coming in at a level we haven’t seen since before the pandemic.

Builders will start seeing some easing in the supply chain issues that hit them hard over the past two years, but development costs will still be high. Trying to balance homebuilding costs with what a consumer can pay (given higher mortgage rates) will likely lead builders to slow activity. This will actually support the resale market, as fewer new homes will increase the demand for existing homes.

8 Not All Markets Are Created Equal

Markets where home price growth rose the fastest in recent years are expected to experience a disproportionate swing to the downside. For example, markets in areas that had an influx of remote workers, who flocked to cheaper housing during the pandemic, will likely see prices fall by a greater percentage than other parts of the country. That said, even those markets will start to see prices stabilize by the end of 2023 and resume a more reasonable pace of price growth.

9 Affordability Will Continue to Be a Major Issue

In most markets, home prices will not increase in 2023, but any price drop will not be enough to make housing more affordable. And with mortgage rates remaining higher than they’ve been in over a decade, affordability will continue to be a problem in the coming year, which is a concerning outlook for first-time buyers.

Over the past two years, many renters have had aspirations of buying but the timing wasn’t quite right for them. With both prices and mortgage rates spiraling upward in 2022, it’s likely that many renters are now in a situation where the dream of homeownership has gone. That’s not to say they will never be able to buy a home, just that they may have to wait a lot longer than they had hoped.

10 Government Needs to Take Housing More Seriously

Over the past two years, the market has risen to such an extent that it has priced out millions of potential home buyers. With a wave of demand coming from Millennials and Gen Z, the pace of housing production must increase significantly, but many markets simply don’t have enough land to build on. This is why I expect more cities, counties, and states to start adjusting their land use policies to free up more land for housing.

But it’s not just land supply that can help. Elected officials can assist housing developers by utilizing Tax Increment Financing tools, whereby the government reimburses a private developer as incremental taxes are generated from housing development. There are many tools like this at the government’s disposal to help boost housing supply, and I sincerely hope that they start to take this critical issue more seriously.

As we approach the Thanksgiving holiday, I want to let you know how grateful I am for YOU! Your friendship, support, and referrals have helped fuel my business and support my family. Thank you!

Real estate is a career that gives me the opportunity to be a meaningful part of my clients’ lives as they navigate important moves that have a great financial impact. I take the responsibility of guiding my clients through this process very seriously and know that when someone places this trust in me that it is a big deal! It is an honor to be a part of your big-picture planning and to help you execute these life changes with care and success.

My Thanksgiving would not be complete without taking a moment to say, thank you and that I appreciate you so much! I hope your holiday is filled with happiness, rest, and all the people that are nearest and dearest to your heart.

In honor of Windermere’s 50th anniversary, we’ve set a goal to reach $50 million in total donations to the Windermere Foundation in 2022 for our 50 in 50 campaign. To reach our goal, we need to raise $4 million in donations this year.

So far this year, through the month of October, $3,594,552 in donations has been raised for the Windermere Foundation. If you’d like to help us reach our goal, you can donate here!

Returning to normal: buyer affordability dictates the market while sellers retain equity.

There is no doubt that 2022 has been one of the most eventful years in real estate. This is saying a lot coming off the record-breaking years of the pandemic. We will probably never see anything like 2020 and 2021 again. During this time the market responded to a historical event that motivated the rearrangement of our communities due to societal shifts all while we had the lowest interest rates ever. It was a doozy of a time! Demand was spurred by the option to work from home; buyers craved the perfect space to be at home and cheap money made these moves plentiful.

The market had a slight pause at the onset of the pandemic in the spring of 2020 and then it took off like a freight train. Heightened demand, cheap money, and low inventory caused prices to increase at the most significant rate we have ever seen. How was this train barreling down the tracks going to slow down? The speed at which this train was moving was not safe or sustainable. The only way to stop it was an increase in interest rates.

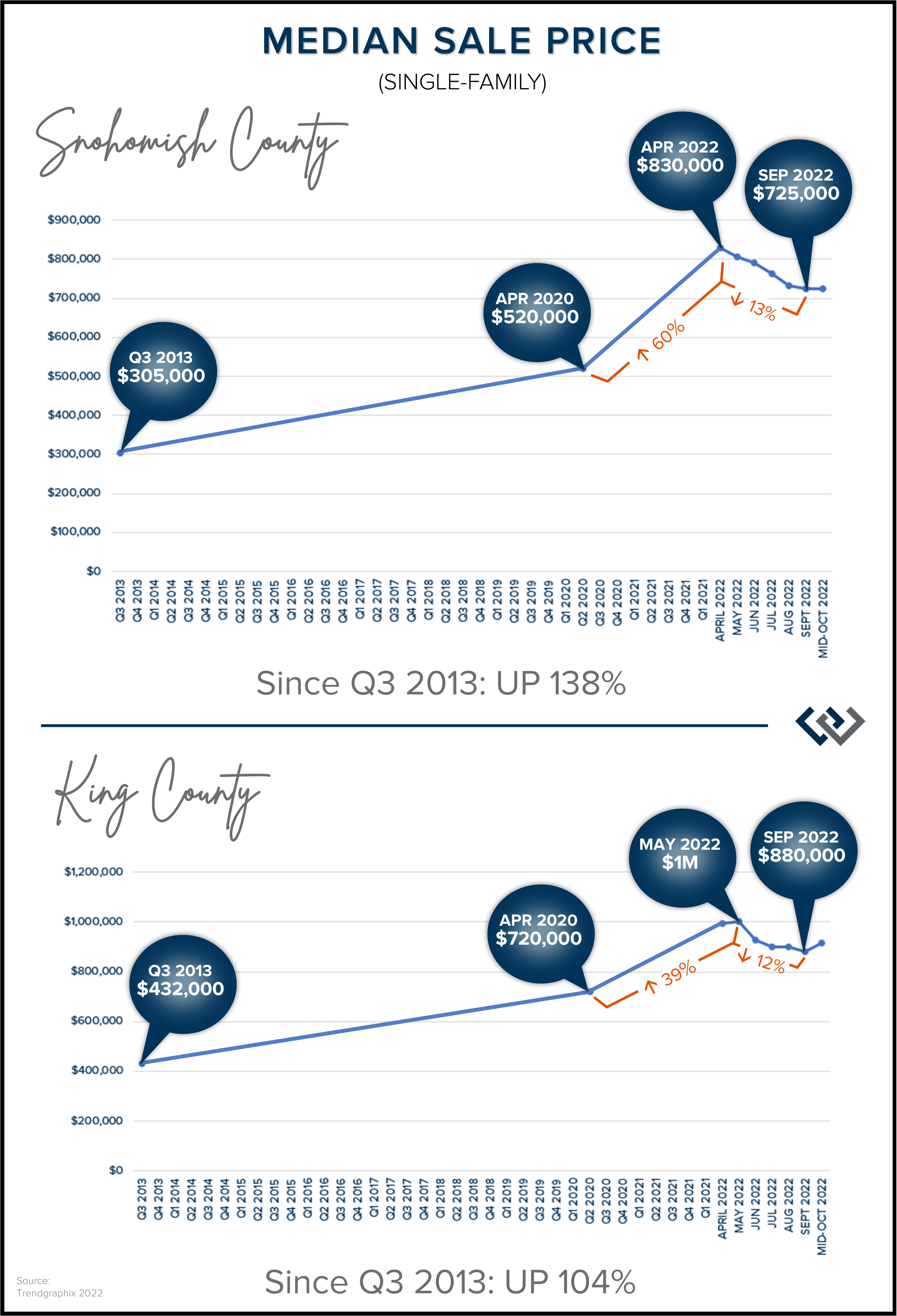

In Snohomish County, from April 2020 to the peak (April 2022) prices grew by 60%, and in King County, from April 2020 to the peak (May 2022) prices grew by 39%. Bear in mind that historical norms for annual price appreciation are 3-5%, making this two-year time period unlike any other! The Fed needed to make the cost of borrowing money more expensive in order to slow down inflation. This was applicable to the entire economy not just real estate, causing short-term rates to increase for credit cards, car loans, and lines of credit, as well as long-term mortgage rates.

In Snohomish County, from April 2020 to the peak (April 2022) prices grew by 60%, and in King County, from April 2020 to the peak (May 2022) prices grew by 39%. Bear in mind that historical norms for annual price appreciation are 3-5%, making this two-year time period unlike any other! The Fed needed to make the cost of borrowing money more expensive in order to slow down inflation. This was applicable to the entire economy not just real estate, causing short-term rates to increase for credit cards, car loans, and lines of credit, as well as long-term mortgage rates.

Since the peak, interest rates have increased by 1.5% and this has put downward pressure on prices and slowed demand. There is a rule of thumb in our industry called the 1/10 rule: for every 1-point change in interest rates, buying power shifts by 10%. For example, if a buyer is pre-approved for a $750,000 purchase at a rate of 5.5% and then the rate increases by 1-point to 6.5% in order for the buyer to have the same monthly payment they must decrease their purchase price by 10% to $675,000. This rule applies when rates go down too, which led to the fierce increase in prices over the pandemic years.

Buyers most often make buying decisions based on the monthly payment and it is no wonder that the new interest rate environment has caused prices to decrease. As you can see from the graph, prices in Snohomish County are down from the peak by 13% and down in King County by 12%, which very much reflects the 1/10 rule, as rates went from 5% on average in April to 6.5% in September. Month-to-date this October, prices in Snohomish County remain even over September prices, and are up slightly in King County.

Expect home prices to adjust based on rate increases, decreases, or stabilization based on the 1/10 rule, not because the sky is falling. Buyers that bought at or around the peak need to keep the faith and understand that real estate is a long-term hold investment with the average homeowner spending at least 8 years in their home. A correction in the market is solved with time and most likely these buyers secured their homes with very low debt service making their payments lower to help them sustain this adjustment. The Fed’s plan is working to slow down the train and help us return to a more sustainable market.

While interest rates are higher than they have been they are still lower than the 30-year average of 7.5% and prices are coming off the peak, but not crashing. In Snohomish County, prices are up 40% from April 2020, and in King County, they are up 22%. Most importantly, long-term price growth since Q3 2013 is up by 138% in Snohomish County and up 104% in King County. In fact, more than 50% of homeowners in WA state have at least 50% equity in their homes making them prepared to make a move when their life-needs will motivate a change. Keeping all of this in perspective will lead sellers to successful moves with a calm understanding of our new normal after an unprecedented time in history.

Buyers are enjoying an increase in selection and more time to make their buying decisions. They now have time to discern these big life changes and to analyze the financial aspect of a move versus needing to make a decision in a 15-minute showing appointment before a home was gobbled up in multiple offers. They are also afforded the opportunity to do further due diligence on the properties they are interested in and negotiate contract contingency terms that protect them throughout the transaction. It is also not uncommon for work orders that a buyer has called out to be added to a contract. We are seeing the occasional multiple offers on homes that are special and priced perfectly, so aligning with a broker who can identify value and opportunity is key so a buyer doesn’t miss out.

Another important aspect for a buyer to consider is the set-up of their financing terms. With rates higher than they have been and the age-old strategy of managing monthly payments always in play, creative financing options such as rate buy-downs and ARMs (Adjustable Rate Mortgages) are additional options to consider when looking at the overall financial picture of making a purchase. Make sure the broker you work with has a collection of reputable lenders that can provide options as each lender will have different programs to choose from.

We are even seeing sellers pay credits on behalf of buyers to buy their rate down in order to make the monthly payment more attainable. The negotiations we are seeing in this market are being dictated by buyer affordability which requires collaboration. Since most sellers have large amounts of equity, we have seen successful meeting-of-the-mind solutions to create win-win outcomes for both sides. As the market comes into balance we are seeing more of a give-and-take and the importance of navigating these changes is critical.

During these times when a market shifts, the cream rises to the top. The listings that are well prepared for the market and priced appropriately will be the winners. Cutting corners and overpricing will lead to frustration and loss. Sellers need to seek out trusted advisors who can properly analyze the new market conditions, bring perspective to their goals, keenly negotiate, and assist them in showcasing their home in the best light possible. Buyers need to align with a professional who understands current market values, can negotiate with data and rapport, assist them in their lending options and help create win-win outcomes.

Brokers like this are not the norm. We are coming off of two years of trying to hold onto a speeding train and now we have the opportunity to steer it through expertise. Expertise is earned and I could not be more passionate about helping my clients navigate the new normal with the tools and experience I bring to the table. I am invested in my clients’ goals and strive to empower strong decisions through thorough research, sound counsel, and clear advocacy. Please reach out if you are curious about how today’s market matches up with your goals or if you know someone I can help.

Did you know Windermere is the official real estate company of the Seahawks?!

The best part of this partnership is our #TackleHomelessness campaign. For every defensive tackle made by the Hawks at their home games throughout the season, The Windermere Foundation donates $100 to Mary’s Place. Our current total is over $200k donated over the last 6 seasons of partnering with the Seahawks.

Since 1999, Mary’s Place has helped thousands of women and families move out of homelessness into more stable situations. Across five emergency family shelters in King County, they keep families together, inside, and safe when they have no place else to go, providing resources, housing and employment services, community, and hope.

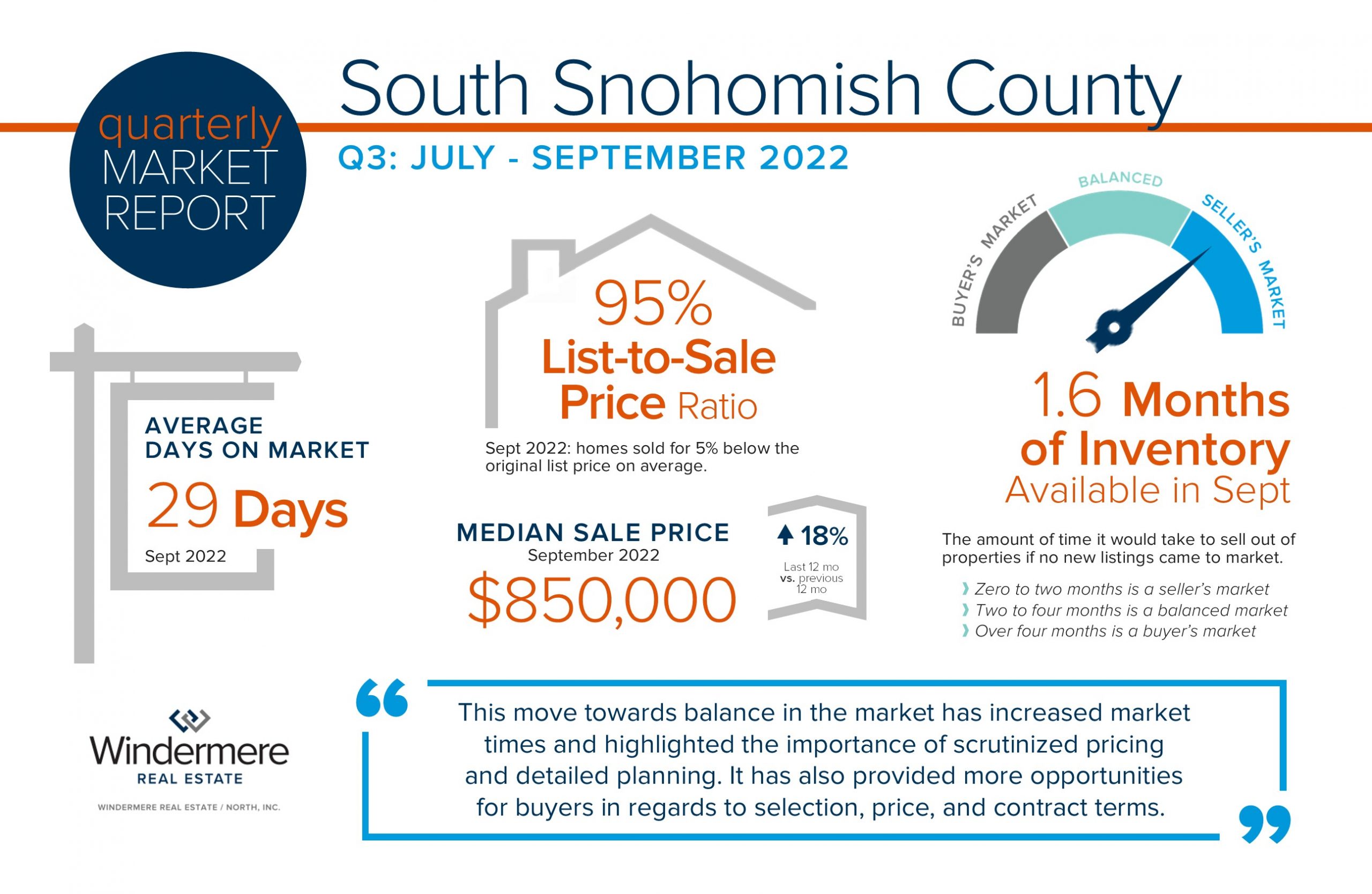

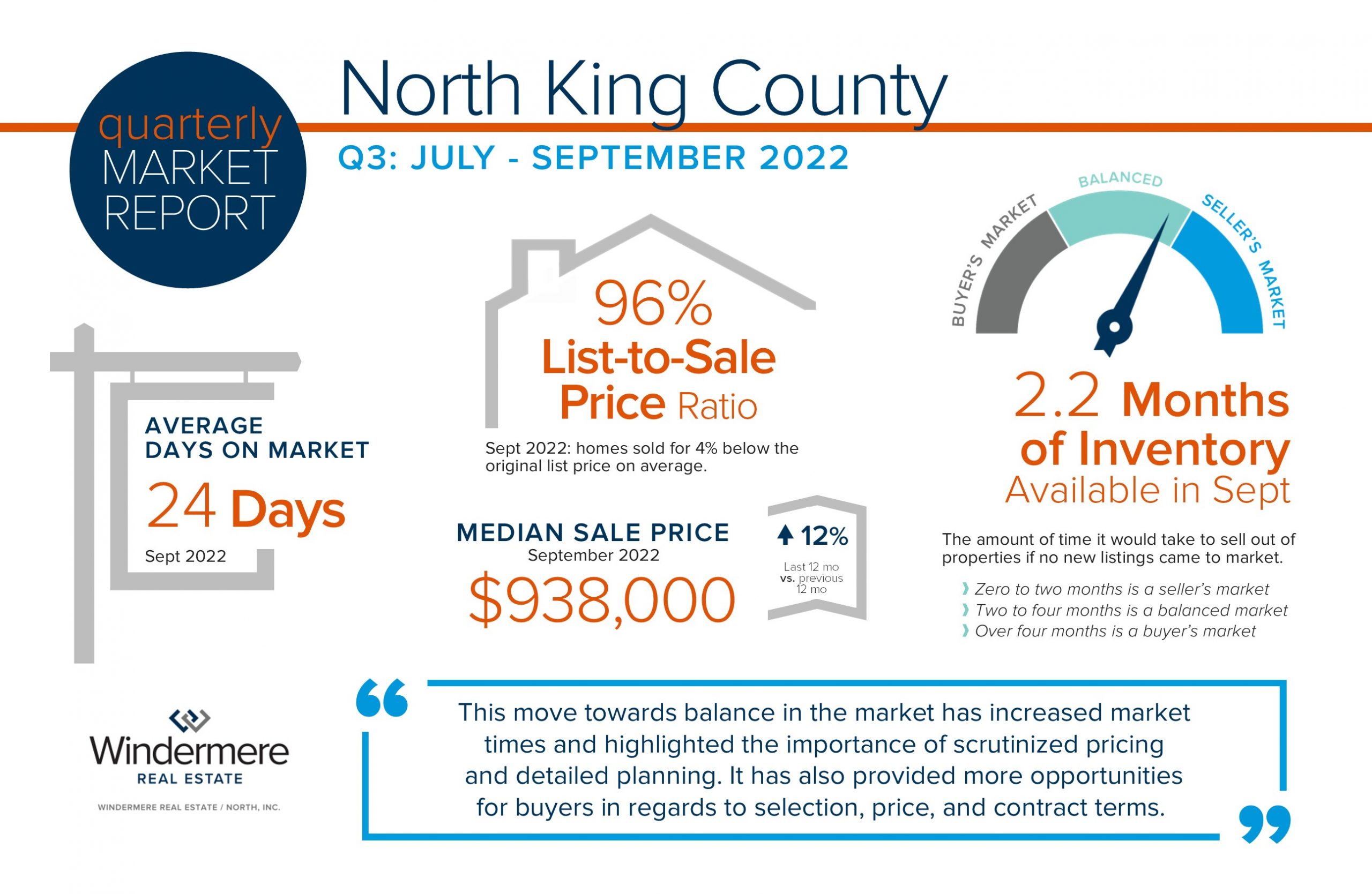

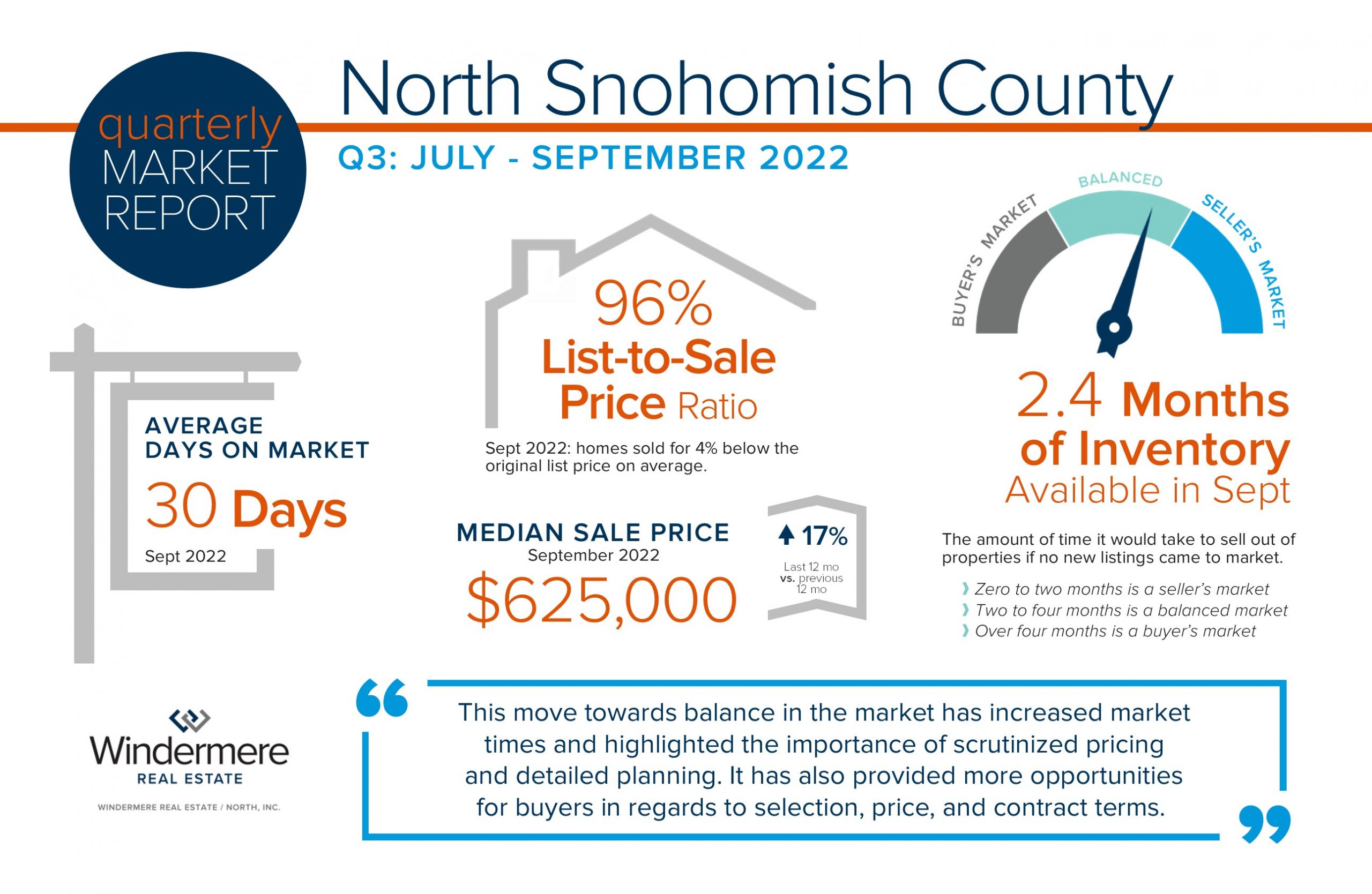

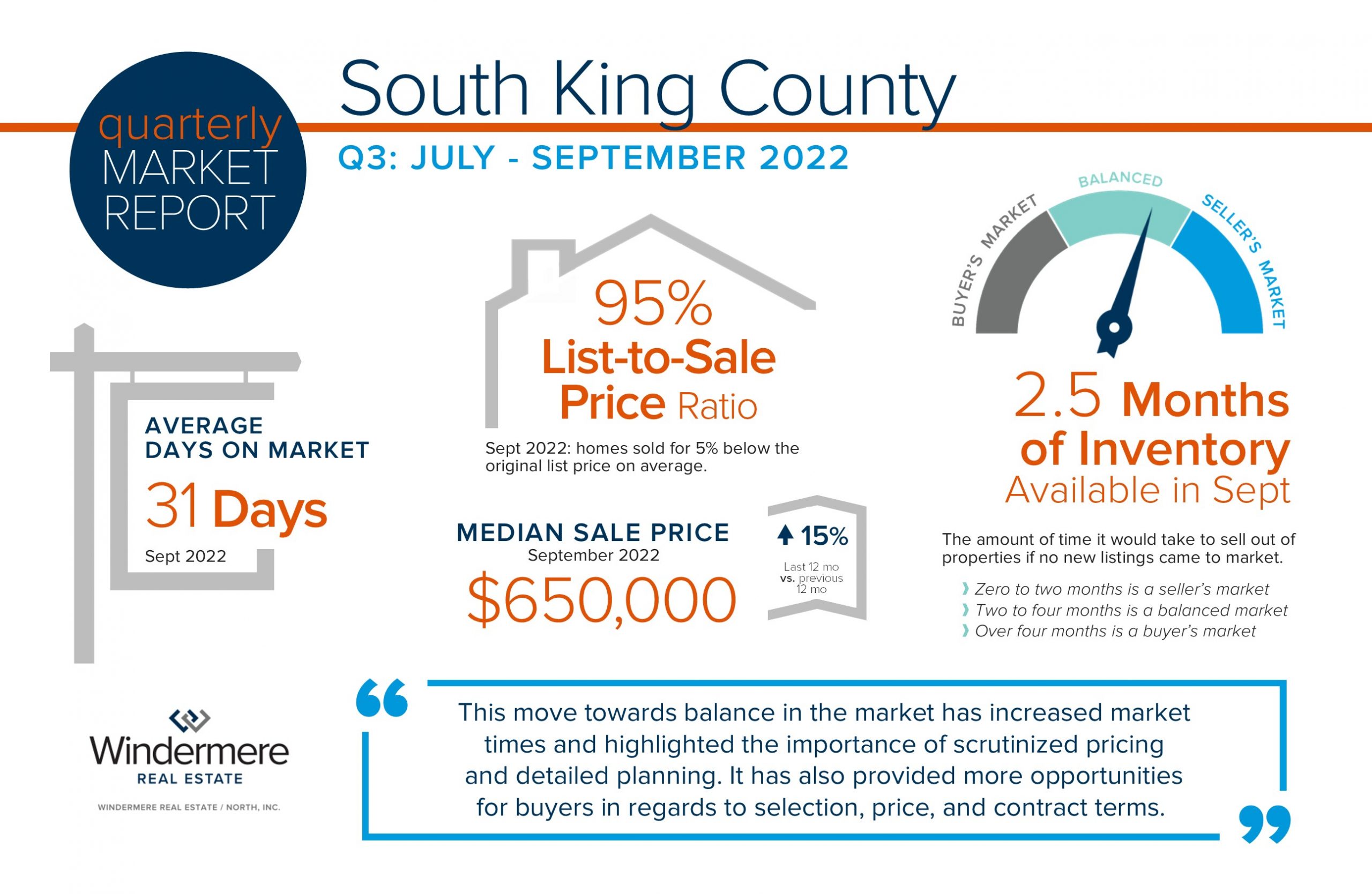

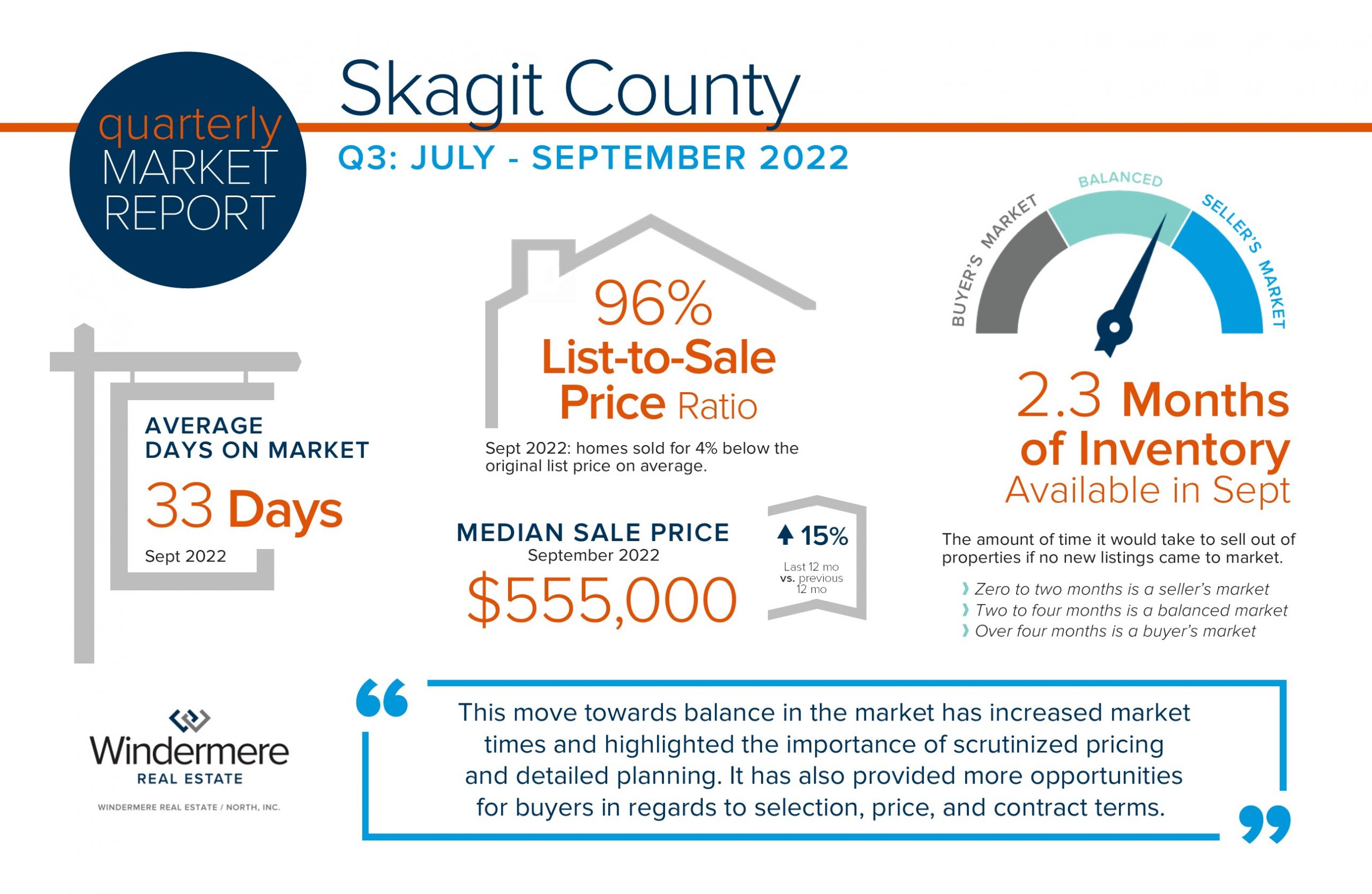

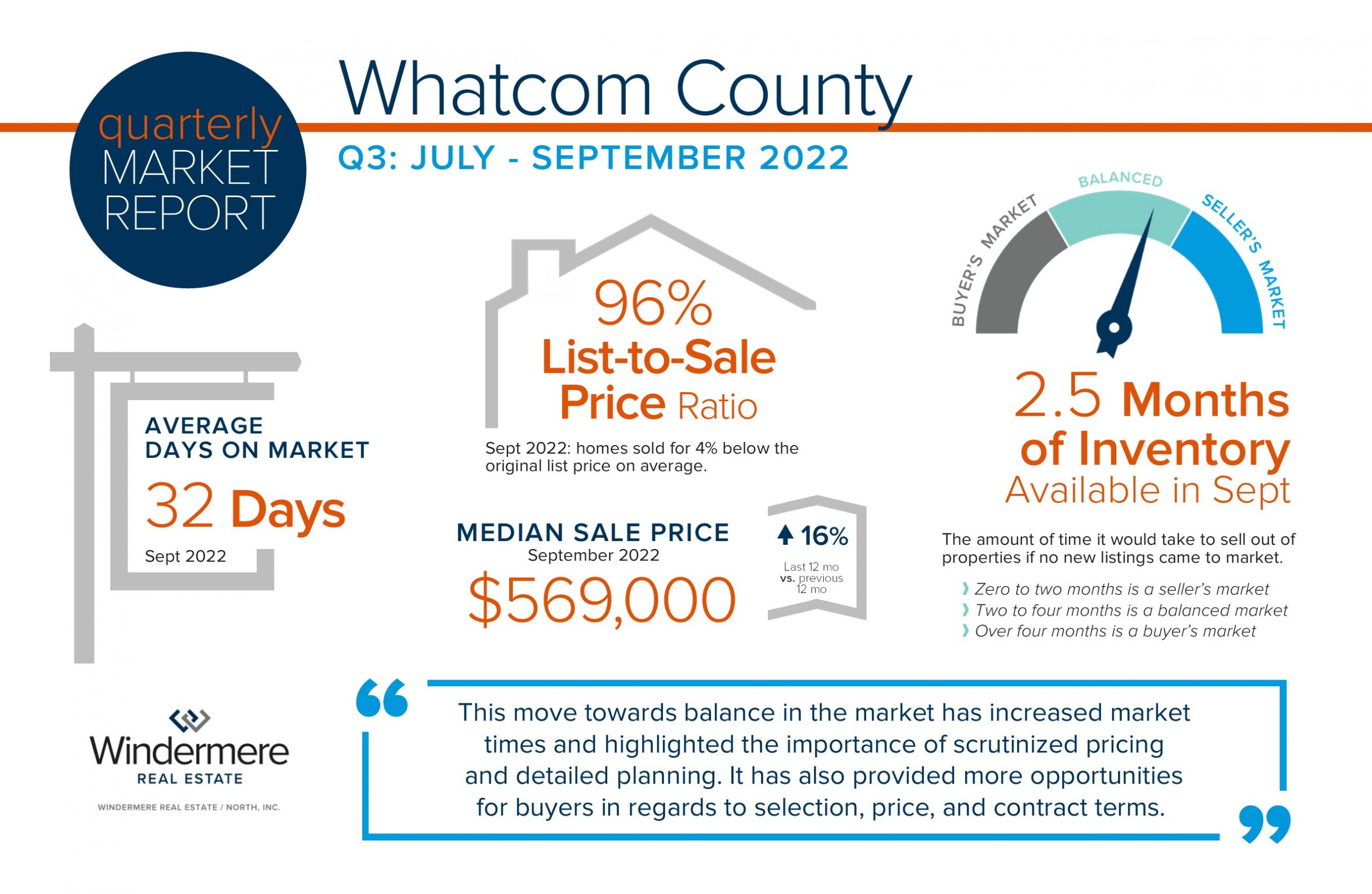

QUARTERLY REPORTS Q3 2022

The real estate market is adjusting to new environmental factors as we round out 2022. Interest rates have been on an upward trend since the spring and have increased by 2 points since the first of the year. This has put downward pressure on the peak prices we saw in the spring as we return to more normalized, historical rates. We must keep in perspective the strong year-over-year price gains as these environmental factors settle out. Additionally, we are sitting on top of 10 years of price growth resulting in over 50% of homeowners in WA state with at least 50% home equity.

The real estate market is adjusting to new environmental factors as we round out 2022. Interest rates have been on an upward trend since the spring and have increased by 2 points since the first of the year. This has put downward pressure on the peak prices we saw in the spring as we return to more normalized, historical rates. We must keep in perspective the strong year-over-year price gains as these environmental factors settle out. Additionally, we are sitting on top of 10 years of price growth resulting in over 50% of homeowners in WA state with at least 50% home equity.

This move towards balance in the market has increased market times and highlighted the importance of scrutinized pricing and detailed planning. It has also provided more opportunities for buyers in regards to selection, price, and contract terms. This market requires keen analytical skills, strategic negotiations, creativity, and a higher level of customer care.

I welcome the balance and normalization and look forward to helping my clients make moves to match their needs in life! Please reach out if you are curious about how the market relates to your goals or know someone that needs my help.

Pumpkin Patches & Fall Activities

Fall has arrived in the PNW and it’s time for cool mornings, warm beverages, beautiful colors, hay rides and pumpkin picking. Head out to a local farm for fresh produce and family-friendly activities.

This is by no means an exhaustive list… there so many farms in our area, especially Snohomish County. Leave a comment with your favorite if it’s not on the list!

*Please always check websites for confirmation of activities, hours, possible closures, and any other details.

SOUTH SNOHOMISH COUNTY

Biringer’s Black Crow Pumpkins & Corn Maze – Arlington

Pumpkin patch and corn maze. Local cider, honey and produce. Fall fun! Pet-friendly.

Bob’s Corn & Pumpkin Farm – Snohomish

Tractor rides, pumpkin patch, corn maze, night maze, bonfire rentals, concessions. Fresh produce at the Country Store and lunch and dinner are available on the weekend at the Country Kitchen.

Carleton Farm – Lake Stevens

No frills pumpkin patch, animals, market, concessions, and free parking are all open to the public at no charge.

Craven Farm – Snohomish

Corn maze, hayride, pumpkin patch, fire pit rentals, concessions, autumn décor.

Legacy Farm – Monroe

Pumpkin patch, kids corn maze, covered hay ride, barrel train, kid zone playground, animals, carnival games, papa’s fire truck, family photo area, festive food & drink.

The Farm at Swans Trail – Snohomish

Pumpkin Patches, fresh-pressed cider, corn maze, concessions. Animals, kids play area, live duck races, pigs show, hay rides, cow train, indoor slides, tractor pull, zip lines and more.

Fairbank Animal Farm & Pumpkin Patch – Edmonds

Pumpkin patch, farm animals, toy duck races, hay tunnel and more.

Stocker Farms – Snohomish

Pumpkin patch, corn maze, family photo areas, concessions, kids play areas, hay ride, bubble barn, duck races, tractor slide, gaga ball, steer & pig roping, and more. New, Saturday nights fireworks extravaganza.

Thomas Family Farm – Snohomish

Pumpkin patch, corn maze, kids fun park, 5-hole putt putt, heated & covered beer garden, escape rooms, haunted house, monster truck rides and more. Night activities: zombie paintball, haunted trail, haunted house.

KING COUNTY

Carpinito Brothers – Kent

Pumpkin patch, corn maze, kids activities, farm animals, hay maze, goat walk. No pets allowed.

Fall City Farms – Fall City

Pumpkin patch, farm animals, concessions. No pets allowed.

Jubilee Farm – Carnation

Pumpkin patch, hay rides, concessions, farm market, and more. Free admission. No pets allowed.

Oxbow Farm – Carnation

Oxtober celebration 10/15, 16, 22, 23: pumpkins, living playground, Oxboat ride on pumpkin river, farm-fresh produce. Registration on website.

Remlinger Farms – Carnation

Pumpkin patch, apple cannon, pony rides, mechanical rides, farm animals, giant swing, play area, pioneer village, concessions and more.

Serres Farm – Redmond

Pumpkin patch, animal train, corn maze.

Thomasson Family Farm – Enumclaw

Pumpkin patch, corn maze, lazer tag, farm animals, play areas, apple slingshot, tetherball, giant Jenga, giant Connect 4, photo ops and more.

Yakima Fruit Market – Bothell

Farm stand with lots of local pumpkins, apples, and farm-fresh produce. Corn stalks, hay bales and fall décor.

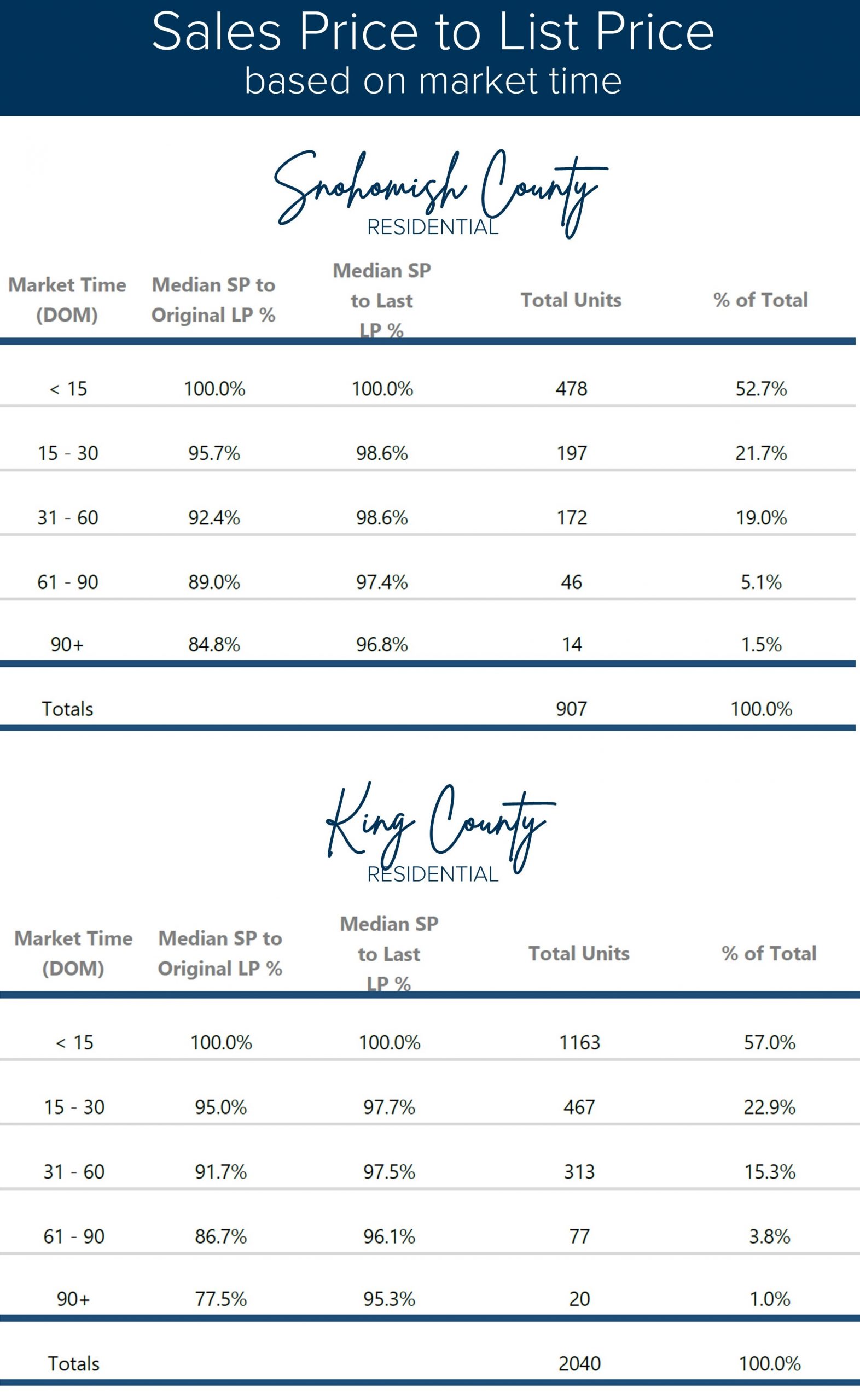

Navigating a balanced market: property preparation, pricing & negotiations.

As we experience the fall equinox, when the length of a day is equal to the night, we are also experiencing a similar balance in the real estate market. We define a balanced market to have 2-4 months of available inventory. This means that if no new homes came to market, we would be sold out of homes in that amount of time. Month-to-date in September, we have 2.1 months of inventory in King County and 1.7 months in Snohomish County, after having 1.6 months in King and 1.5 months in Snohomish in August. This has been a stark contrast to the spring months when we bottomed out at 0.3 months in both counties in March.

As we experience the fall equinox, when the length of a day is equal to the night, we are also experiencing a similar balance in the real estate market. We define a balanced market to have 2-4 months of available inventory. This means that if no new homes came to market, we would be sold out of homes in that amount of time. Month-to-date in September, we have 2.1 months of inventory in King County and 1.7 months in Snohomish County, after having 1.6 months in King and 1.5 months in Snohomish in August. This has been a stark contrast to the spring months when we bottomed out at 0.3 months in both counties in March.

How we navigate the changing environment is key! The reasons why people buy and sell real estate is often rooted in life changes. Yes, real estate is an investment and often leads to financial gain, but moves are more likely motivated by life circumstances that create a desired change in housing. So how do you find success in a market approaching or already in balance, versus an extreme seller’s market?

First, market preparation should not be taken lightly. How a home is presented to the market is instrumental in setting it apart from the increase in the competition (more inventory), so it stands out and sells quicker. As a part of my process (in all markets), I walk through the property with my sellers and we devise a plan to improve, clean, and sometimes update the property so it shows as favorably as possible in order to attract the largest pool of buyers possible. With more selection, this preparation is paramount to getting the highest return and shortest market time.

I will often refer to my preferred list of contractors to help take on our prep list and I can also consult on what items are of the highest priority to improve, so we do not cut into profit. Windermere even has a no-upfront, low-cost loan program, The Windermere Ready Program that allows for quick and inexpensive access to funds in order to get property preparation done seamlessly.

The second key element is pricing. In King County, prices are up 10% complete year-over-year and up 18% in Snohomish County. However, prices are down 10% from the spring 2022 peak in King County and 12% in Snohomish. Price appreciation has started to decelerate (slow down) year-over-year, but we still have above-average price gains when we compare 2021 to 2022. Not to mention, we are sitting on top of a decade of positive price appreciation. The long-term equity growth a seller has is a healthy perspective to set their expectations on rather than holding on to the extreme environment of the spring market that is not returning.

With that said, sellers have amazing gains to enjoy, and not overshooting their price will lead to the most profitable and drama-free outcome. In King County in August, 37% of homes sold at or above the list price, and 34% in Snohomish County; that is 1 in 3 homes! These homes were brought to market with accurate pricing that attracted a buyer pool that understood the value and was motivated to offer. Market time was also shorter. Homes in King and Snohomish Counties that sold in 15 days or less averaged a list-to-sale price ratio of 100% and homes that sold in 15-30 days took close to a 5% hit on list price. When the days on market get longer the hit on list price gets even higher. It is important to get the pricing right in the beginning. Thorough research, properly focused perspective, and clear communication all play into this success.

Lastly, negotiations have changed. In the extreme seller’s market, it was all about buyers waiving all their contingencies and a willingness to pay high amounts over the list price to win a home because the selection was low and money was cheap. Now that interest rates have increased, prices have been tempered by the cost of a loan, putting downward pressure on the peak prices from the spring. This is a sign of the market coming into balance. All of these financial factors hinge on one another and are related. We must understand this when we establish a price and head into negotiations. We need to know when to lean into the data and draw a line in the sand on our value, and when to be open and acquiesce to a solution. Having the emotional intelligence to see the big picture and work towards win-win outcomes serves everyone well. This muscle is being rebuilt across the industry; make sure you are aligning with a professional who is well-researched, calm and confident.

What has been really positive about this shift is the ability for a buyer to be a bit more nimble with their move, especially if they have a home to sell. Before, there was a stop-gap in the market because if a seller who was a buyer had to sell their home in order to buy, they were fearful that they would not find a place to live and would have to move twice. Now we are seeing home sale contingencies happen, and buyers whose homes are under contract are making offers subject to those successful closings. It has also allowed for less-rushed due diligence, which is much more comfortable and reduces risk.

One last element I will add is that market conditions vary from neighborhood to neighborhood and price point to price point. Another element we must be aware of as we move away from the extreme is that we cannot make sweeping statements about the market. Some markets are in balance, some are still a seller’s market, and some are leaning towards the favor of buyers. The detail and care that is required to properly educate our clients are more important than they have been in some time and one that I take great pride in.

The answer is often, “it depends” which is followed by a stockpile of research, discernment, and communication in order to formulate a strategic plan and create a successful outcome. It is always my goal to keep my clients well-informed and empower strong decisions. Please reach out if you are curious about the success you can find in our new market. As stated above, life changes often motivate moves, and helping people navigate these huge, life-changing moments is my passion.

Did you know Windermere is the official real estate company of the Seahawks?!

The best part of this partnership is our #TackleHomelessness campaign. For every defensive tackle made by the Hawks at their home games throughout the season, The Windermere Foundation donates $100 to Mary’s Place. Our current total is over $200k donated over the last 6 seasons of partnering with the Seahawks.

Since 1999, Mary’s Place has helped thousands of women and families move out of homelessness into more stable situations. Across five emergency family shelters in King County, they keep families together, inside, and safe when they have no place else to go, providing resources, housing and employment services, community, and hope.

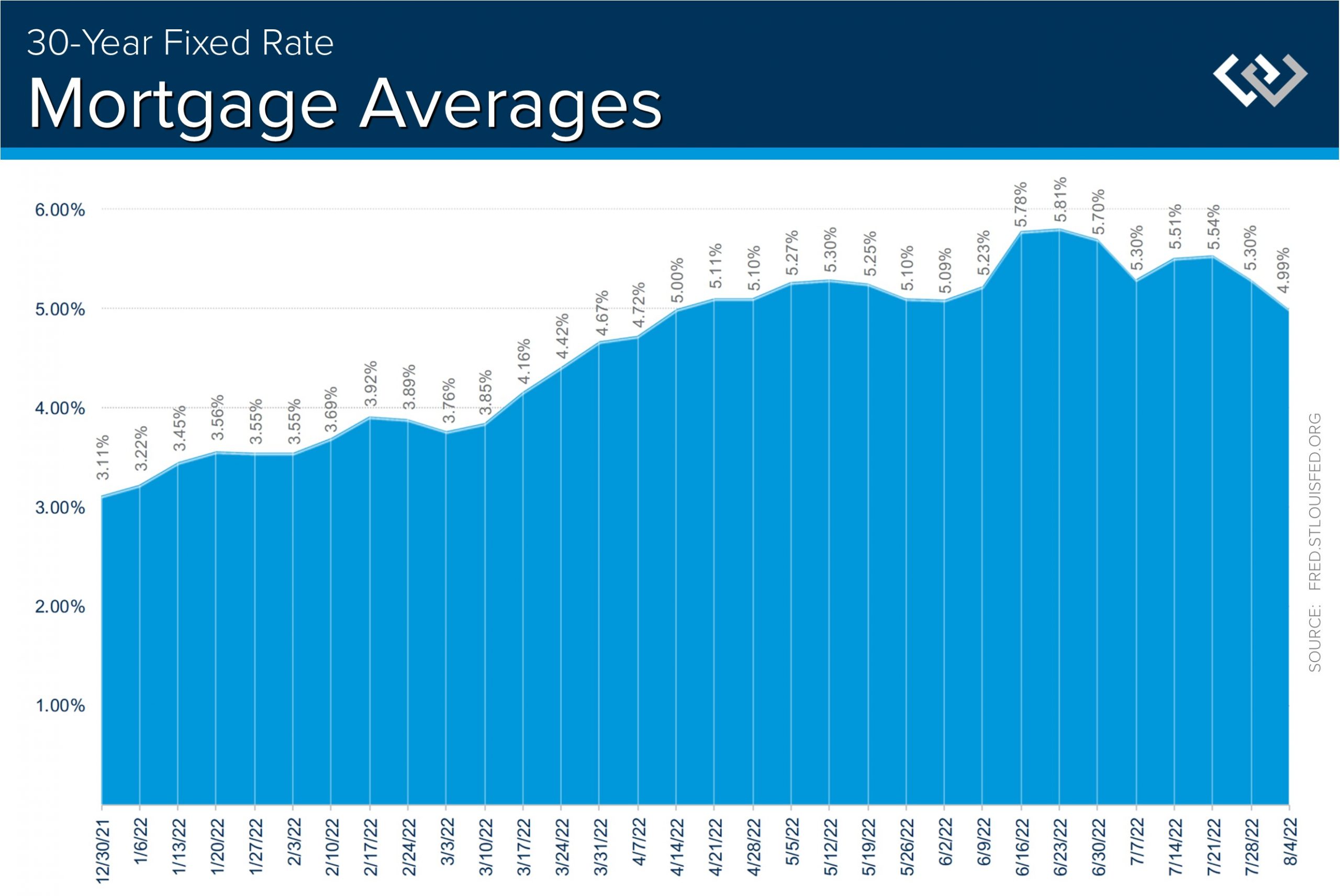

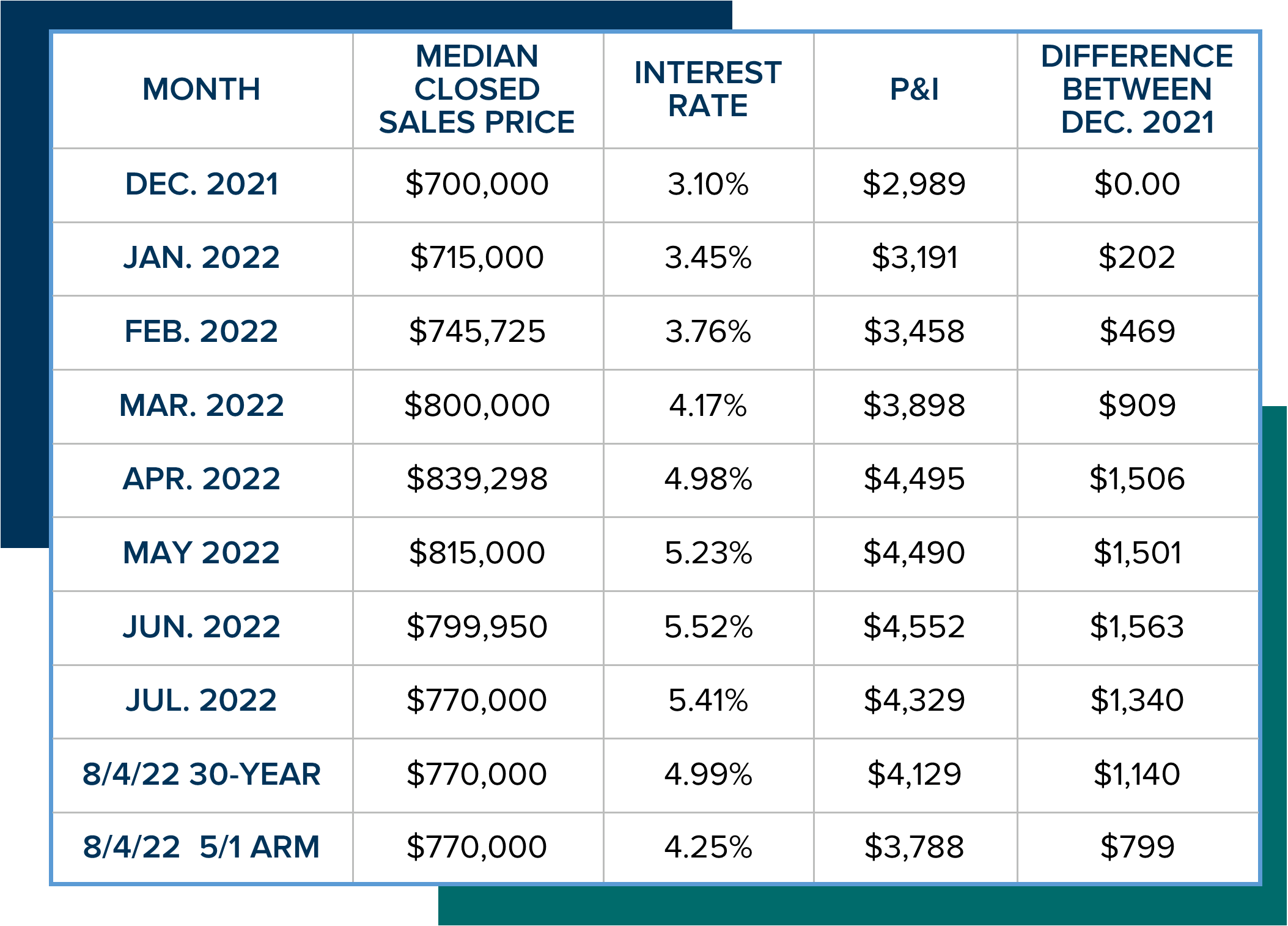

Understanding the Current Shift in the Real Estate Market: How Interest Rates Affect Prices

As we continue to examine the shift in the market, we must take a moment to take a deep dive into interest rates. Since the first of the year, long-term interest rates have increased 2.7% from 3.11% on 12/30/21 to the peak of 5.81% on 6/23/22, but have started to level out. On 8/4/22 rates found themselves at 4.99% which provided more opportunities for buyers and helped increase demand. These are the base rates that are released but can shift up based on the loan program or elements in the buyer’s application, like a credit score.

You see, affordability has been a challenge with the incredible price appreciation we have seen over the last two years. The median price is up 34% ($568,000 to $760,000) from July 2020 to July 2022 in Snohomish County and up 24% ($729,000 to $900,000) in King County. Average annual price gains are typically 3-5% making these last two years a time of significant growth. This is on top of 10 straight years of positive price growth. Homeowners are sitting on a ton of equity!

These recent extreme price escalations were directly connected to the historically low interest rates that were in the 3-4% starting in the spring of 2019 and lasted until the spring of 2022. To combat inflation the Fed made the move they’ve been talking about for some time and started to raise interest rates. This started to take shape in April, peaked in June, and has now started to stabilize as we head into the dog days of summer. As rates start to normalize it is putting downward pressure on the peak prices. Bear in mind that the average interest rate over the last 30 years is around 7.5% which we are well below. This low-rate environment was also coupled with a scarcity of inventory and now we are starting to see more selection and a shift from a sellers’ market (0-2 months of inventory) to a balanced market (2-4 months of inventory).

Buyers often choose their price point based on the monthly payment they will need to sustain throughout the term of their loan, not necessarily the highest price they are qualified for. If you look at the chart below you can easily see what buyers are needing to consider financially and how that would price them out of the higher price points. That has directed the demand to adjust to lower price points in order to provide a monthly payment that is sustainable and affordable. Hence, putting downward pressure on the peak prices we saw in spring 2022 when rates were in the 3-4% and there were only 2 weeks of available inventory in Snohomish and King counties. Now there is 2 months of available inventory for both counties, which is an indicator of a balanced market.

The sky is not falling, we are just adjusting to the new normal of interest rates and getting used to having additional selection and competition. Prices are still up significantly year-over-year and homeowners are sitting on a mound of equity built over the last decade. Prices have come off the peak of April 2022, but are starting to recalibrate in relation to the cost of debt service. We anticipate this correction to level out in the coming months. Experts are predicting rates to simmer in the 5% with the hopes of not entering into the 6% like we saw in June as the volatility of this adjustment was finding its way as a response to inflation.

It is also important to understand that mortgage rates are long-term rates and when you hear in the news that the Fed is going to hike interest rates to combat inflation, that it is often short-term rates they are referring to such as car loans, credit cards, and home equity lines of credit. The point of the short-term rate hikes is to get people to slow their spending and save more to hedge against inflation. In fact, the last short-term rate hike caused long-term mortgage rates to lower. Make sure you are consulting an expert and not just listening to the media.

I will continue to keep a close eye on rates, prices, and inventory so my clients are equipped with the most up-to-date information. We must understand all three of these elements are directly connected to each other and they will adjust and find balance. Our local job market is strong, home equity is high, interest rates are still well below the 30-year average, and there is a lot that is motivating the economy. While we may be experiencing a recession, we are not experiencing a dismal housing market. Sales are maintaining at the same level as 2018 and 2019 which were very strong years in real estate, but a bit less than the pandemic-fueled years of 2020 and 2021 that saw a reorganization of our communities due to the work-from-home phenomenon.

Real estate has always been a long-term hold investment and also the place you call home. It must be looked at from a financial perspective and a lifestyle one as well. We are starting to see some creative options in the market with rate buy-downs, even seller credits, and some buyers opting for ARMs (adjustable-rate mortgages) in order to get the payment that works for them. Please reach out if you have questions or are curious about how your goals relate to today’s market. It is always my goal to help keep my clients well informed and empower strong decisions.

In honor of Windermere’s 50th anniversary, we’ve set a goal to reach $50 million in total donations to the Windermere Foundation in 2022 for our 50 in 50 Campaign. To reach our goal, we need to raise $4 million in donations this year. So far this year, through the month of July, $2,011,963 in donations has been raised for the Windermere Foundation.

Our office is just finishing a Summer Food Drive that will help contribute to this total, but more importantly, will help keep the local food banks stocked. We have partnered with Volunteers of America of Snohomish County and they recently shared with us that their need is high due to the increase in the cost of groceries. We are always looking to direct our giving to areas of high need right in our own backyard. We will continue to support the food banks throughout the year with additional food drives around the holidays. Please let me know if you want to participate and I’ll help make that happen!

Understanding the real estate market shift: Location is key!

There is an old adage in real estate: location, location, location. Where a property is located has the biggest influence on its value. Through the pandemic years, we saw a shift in how the location was valued. Before remote working became more common, homes located in neighborhoods that were closer to job centers such as Seattle were at a premium. They still are, but with more people working from home, there was a huge rush to suburban and even rural locations which quickly increased the values of those neighborhoods. You couple this re-organization of our communities with the lowest interest rates in history and voila, you have an incredible run-up in prices over a two-year period.

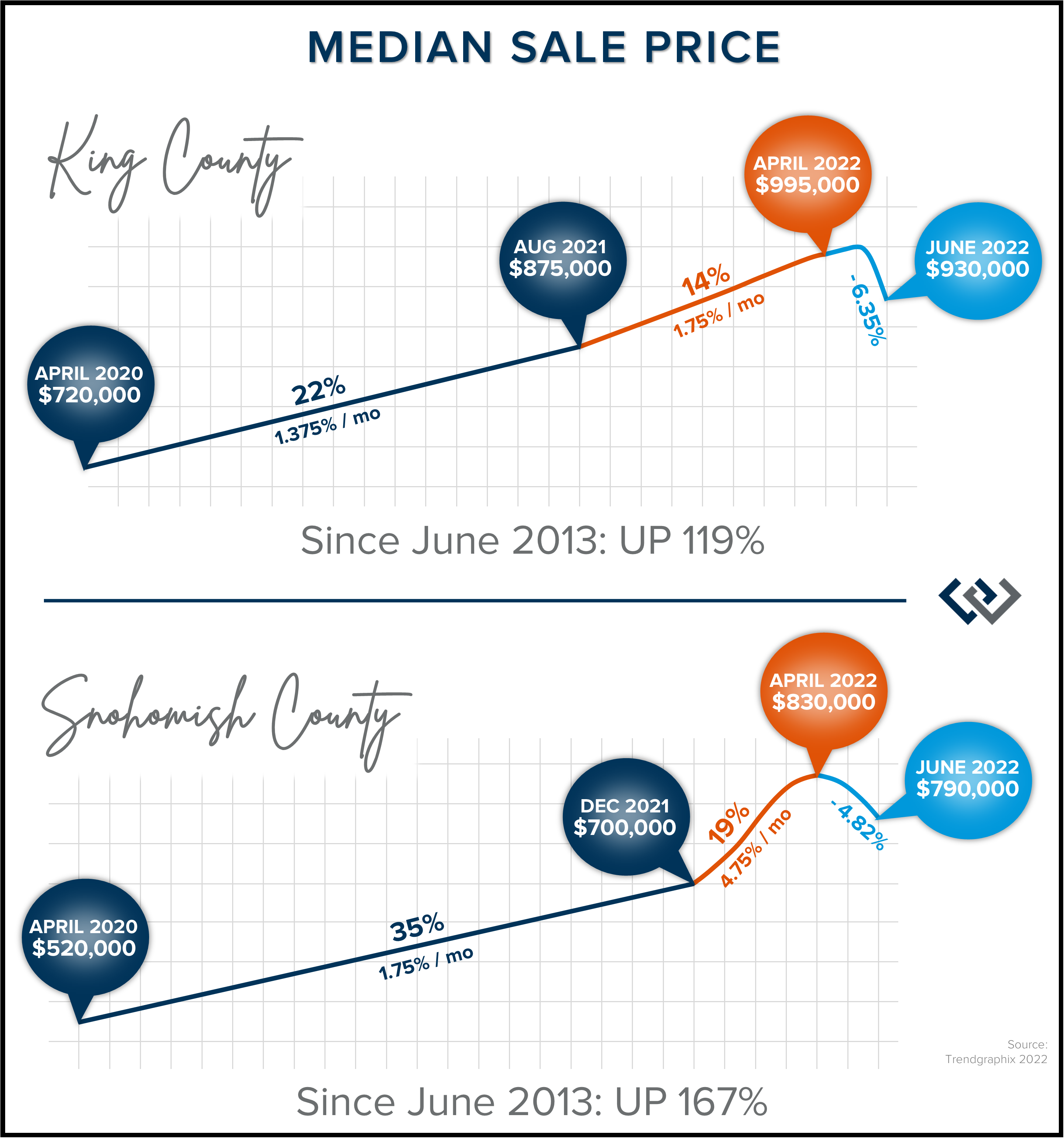

In Snohomish County, in April of 2020, the median price was $520,000 and in April of 2022 the median price was $830,000 – this is a 60% increase in 2 years! In King County, in April of 2020, the median price was $720,000 and in April of 2022 the median price was $995,000 – this is a 38% increase in 2 years! Historical averages for annual price appreciation are closer to 3-5% making this record-breaking.

For the buyers who bought during these peak times, it is understandable that there is some angst over the shift in the market. They can find comfort in the low rate they secured, which created a lower payment and offsets the money they put towards debt service. They also need to understand that real estate has always been a long-term hold investment and that future price appreciation is anticipated, but at more historical norms.

For the buyers who bought during these peak times, it is understandable that there is some angst over the shift in the market. They can find comfort in the low rate they secured, which created a lower payment and offsets the money they put towards debt service. They also need to understand that real estate has always been a long-term hold investment and that future price appreciation is anticipated, but at more historical norms.

Since the start of 2022, we have seen a 2-point increase in interest rates which has started to level out this wild price appreciation. Interest rates were at all-time lows and are higher now, but still below the 30-year average of 7.5%. In addition, the work-from-home (WFH) phenomenon has settled in. Meaning the companies that decided to adapt to the WFH model did already, and many of those employees made those moves in 2020-2021. Some companies are having their employees return to the brick and mortar in some cases permanently, but in most cases periodically. This has tempered the mobility from urban to suburban locations as that shake-out happened more immediately as a result of companies changing shape at the onset of the pandemic.

Higher interest rates, WFH finding its balance, and inflation have created the shift we are experiencing in the market. While it might give some an uneasy feeling, it is in truth a good thing. The price growth that we saw from 2020 to 2022 was not sustainable and returning to historical appreciation norms will put us back in a healthy balance.

We are coming off the peak prices we saw in April of 2022 as the market finds its footing. June median price in Snohomish County is down 4.82% from April and in King down 6.53%. Bear in mind though, that the median price in Snohomish County is up 20% complete year-over-year (the last 12 months over the previous 12 months) and in King 13%. Even more so, the median price in Snohomish County is up 167% since June 2013 and in King by 119%. Equity growth is abundant and sellers are making great returns. This must be kept in perspective as we return to balance in the market and prices level out!

We are coming off the peak prices we saw in April of 2022 as the market finds its footing. June median price in Snohomish County is down 4.82% from April and in King down 6.53%. Bear in mind though, that the median price in Snohomish County is up 20% complete year-over-year (the last 12 months over the previous 12 months) and in King 13%. Even more so, the median price in Snohomish County is up 167% since June 2013 and in King by 119%. Equity growth is abundant and sellers are making great returns. This must be kept in perspective as we return to balance in the market and prices level out!

This has created more inventory in the market giving buyers more selection and time to weigh their options. Where before a buyer had only hours to make one of the biggest decisions of their lives, they can now ponder and assess over the course of days. Not to mention, buyers are now securing contracts with contingency protections to ensure their due diligence is timely and secure. We have seen an increase in days on the market overall, but the days on market for the desirable “cream puff” listings are still very short. A buyer should be aligned with a broker that can help them discern their options.

You see, the new assortment of inventory is a bit jumbled, if you will. Some sellers are not leaning into the balance in the market and have their listings misplaced in the wrong price range. This is confusing to buyers and requires a quick and thoughtful assessment of value by their broker so they can make a clear decision. This ensures a buyer does not overpay but also ensures a buyer doesn’t miss out on a great home that will go quickly.

Some neighborhoods are still in a seller’s market environment and some are in balance, it depends! A seller’s market is considered 0-2 months of inventory, a balanced market is 2-4 months and a buyer’s market is 4+ months. Even more so, some neighborhoods’ market conditions vary by price point, so it is important that you take a forensic approach to the analysis of each location from a macro to a micro approach. For example, in southwest Snohomish County between $700,000-$800,000 it is still a seller’s market; but from $800,000-$900,000 it is a balanced market.

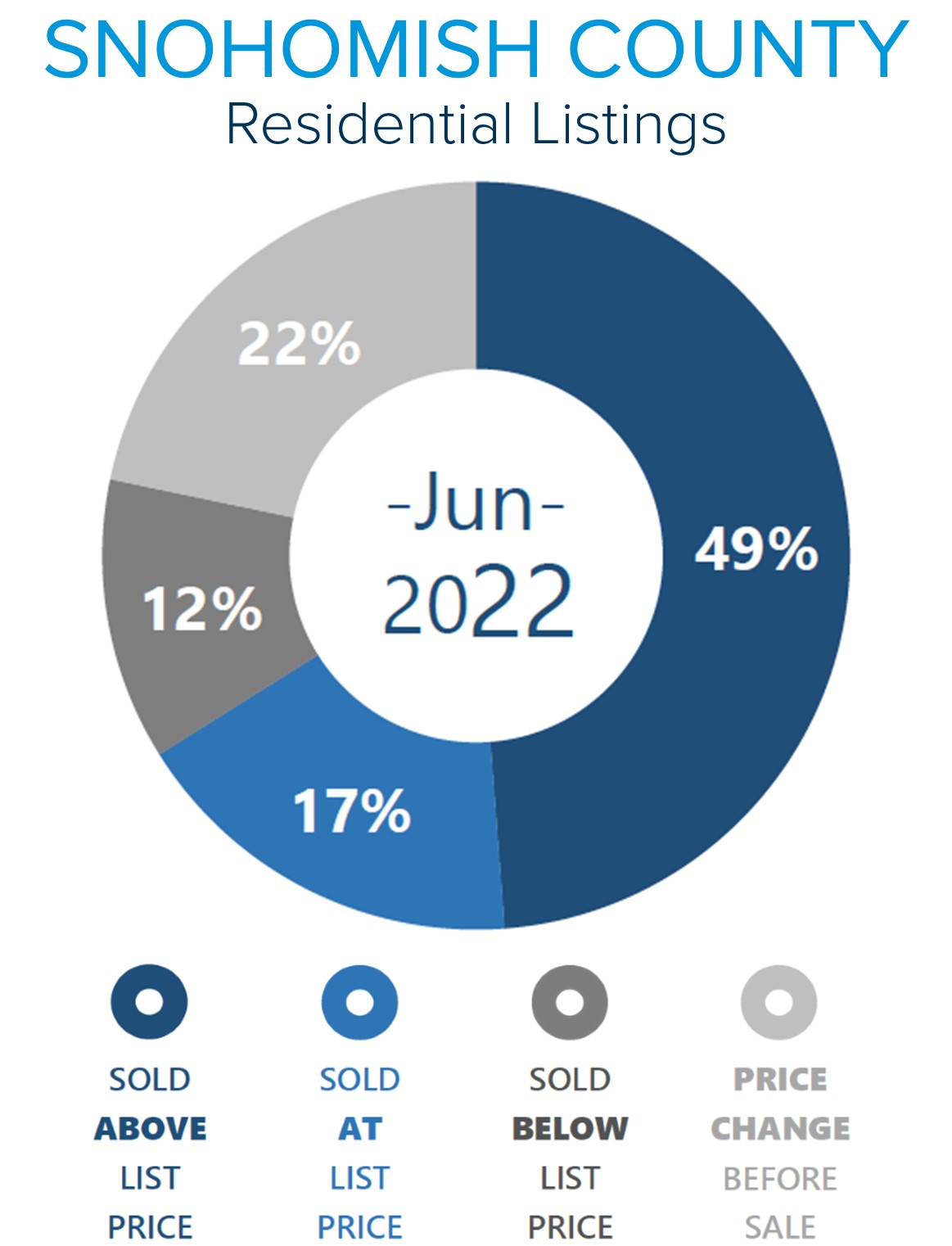

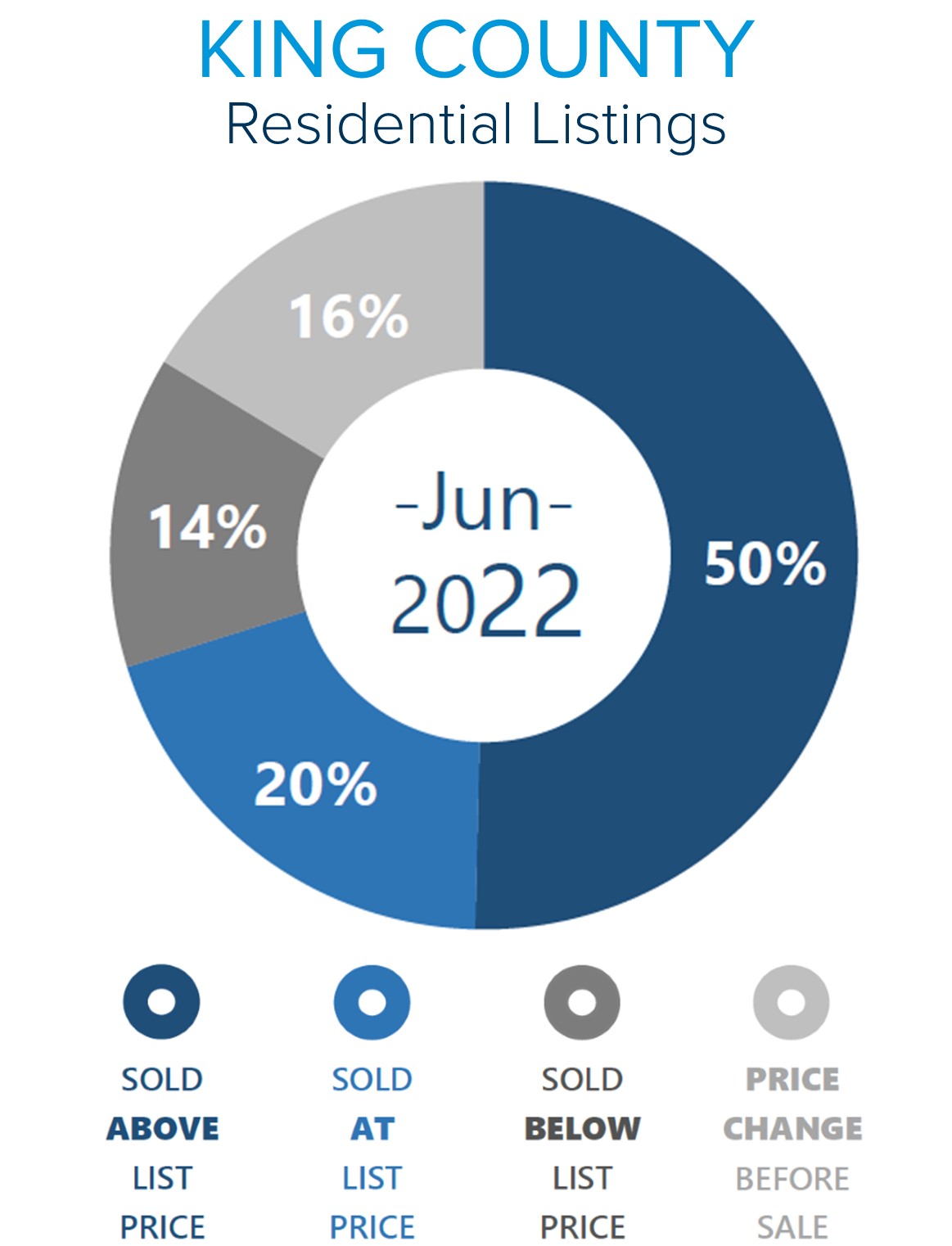

In Snohomish County, days on market for homes that sold in June for over list price was 5 days, which accounted for 49% of the sales with an average escalation of 5%. This illustrates that there are still great homes that buyers are flocking to, but it is imperative that they are properly positioned in the market. This takes skill, research, and a reasonable approach to find this success as a seller. Conversely, 34% of sales in June sold under list price or took a price reduction and averaged 12 days on market and 27 days on market respectively. This mash-up requires sophisticated navigation and reasonable cooperation, but ultimately sellers will find success because they are sitting on a mound of historical equity growth.

In Snohomish County, days on market for homes that sold in June for over list price was 5 days, which accounted for 49% of the sales with an average escalation of 5%. This illustrates that there are still great homes that buyers are flocking to, but it is imperative that they are properly positioned in the market. This takes skill, research, and a reasonable approach to find this success as a seller. Conversely, 34% of sales in June sold under list price or took a price reduction and averaged 12 days on market and 27 days on market respectively. This mash-up requires sophisticated navigation and reasonable cooperation, but ultimately sellers will find success because they are sitting on a mound of historical equity growth.

In King County, days on market for homes that sold in June for over list price was 5 days, which accounts for 50% of the sales with an average escalation of 6%. Conversely, 30% of sales in June sold under list price or took a price reduction and averaged 13 days on market and 27 days on market respectively.

In King County, days on market for homes that sold in June for over list price was 5 days, which accounts for 50% of the sales with an average escalation of 6%. Conversely, 30% of sales in June sold under list price or took a price reduction and averaged 13 days on market and 27 days on market respectively.

As we head into the dog days of summer, I am sharpening my pencil on this new market and taking inventory of the opportunities it is providing for both sellers and buyers. It is also a market that will see attrition of brokers, as many only know how to exist in the feverish seller’s market. Each market takes skill, but navigating change is where we will see the cream rise to the top. If you are curious about how your real estate goal aligns with today’s market, please reach out. It is my mission to help keep my clients well informed and empower strong decisions.

We are holding a Food Drive through the month of July, with a goal to donate $5,000 to the Volunteers of America Food Banks across Snohomish County. You can donate here, or bring non-perishable donations to my office through the month of July.

Thank you!

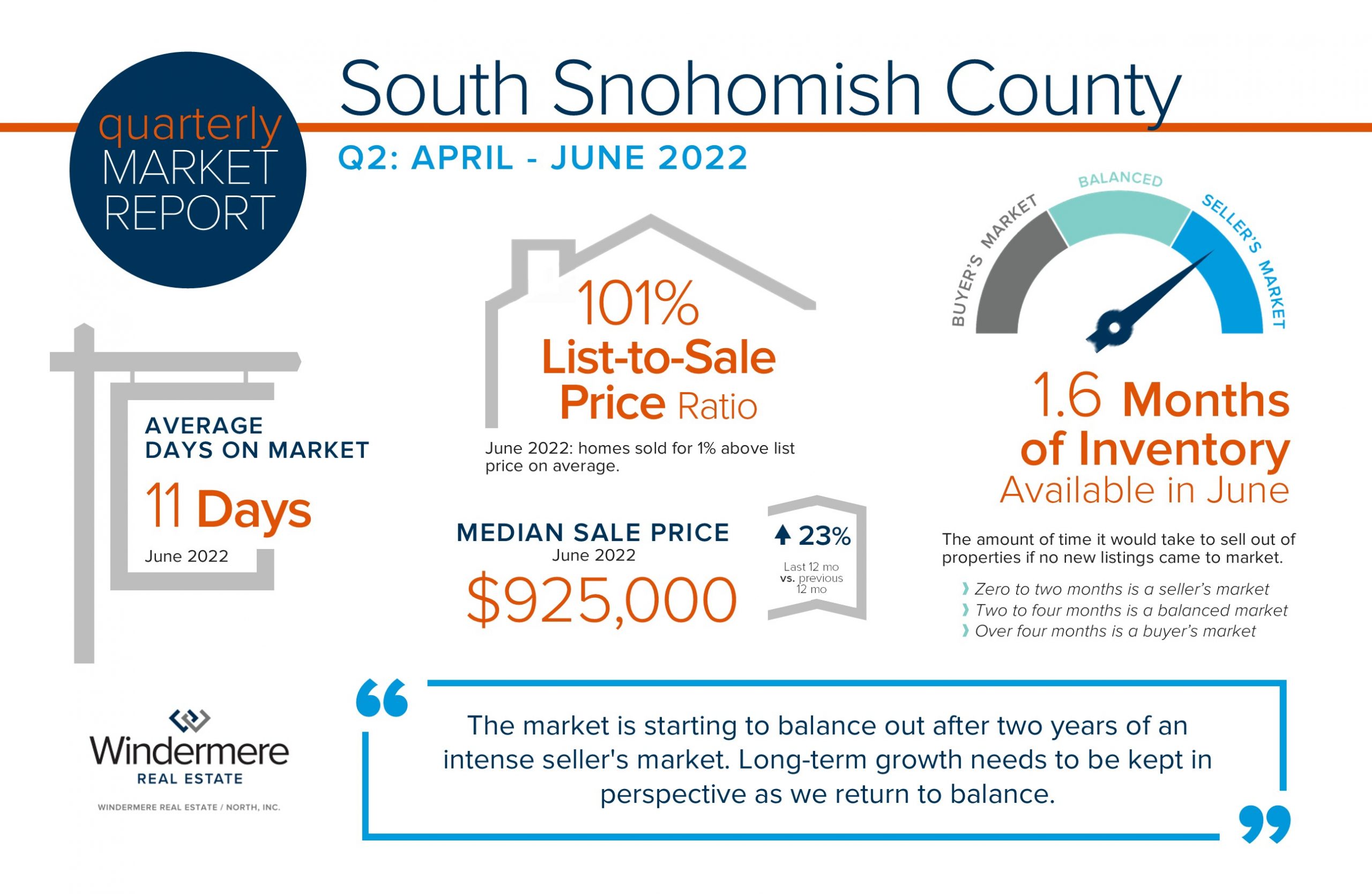

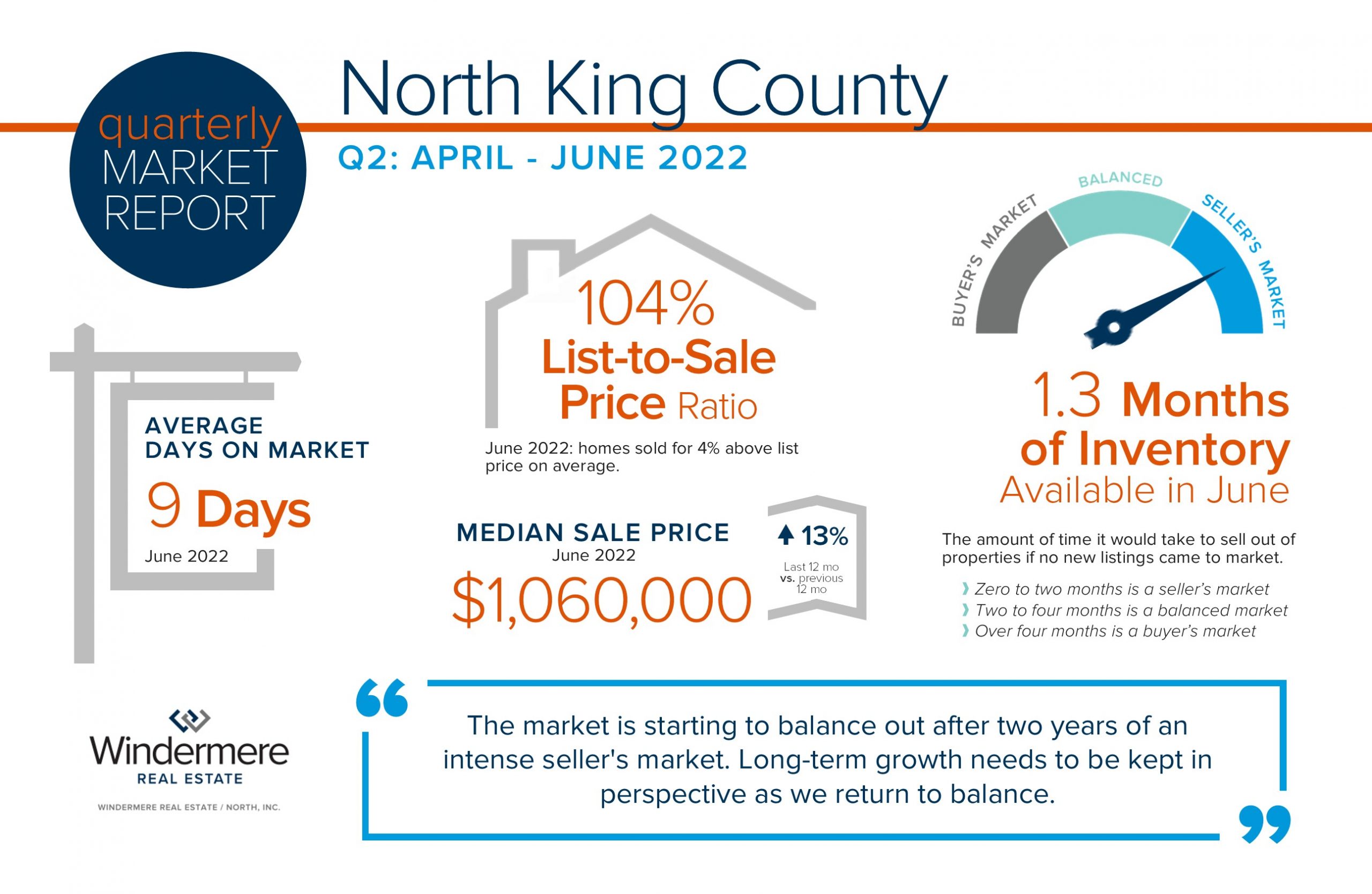

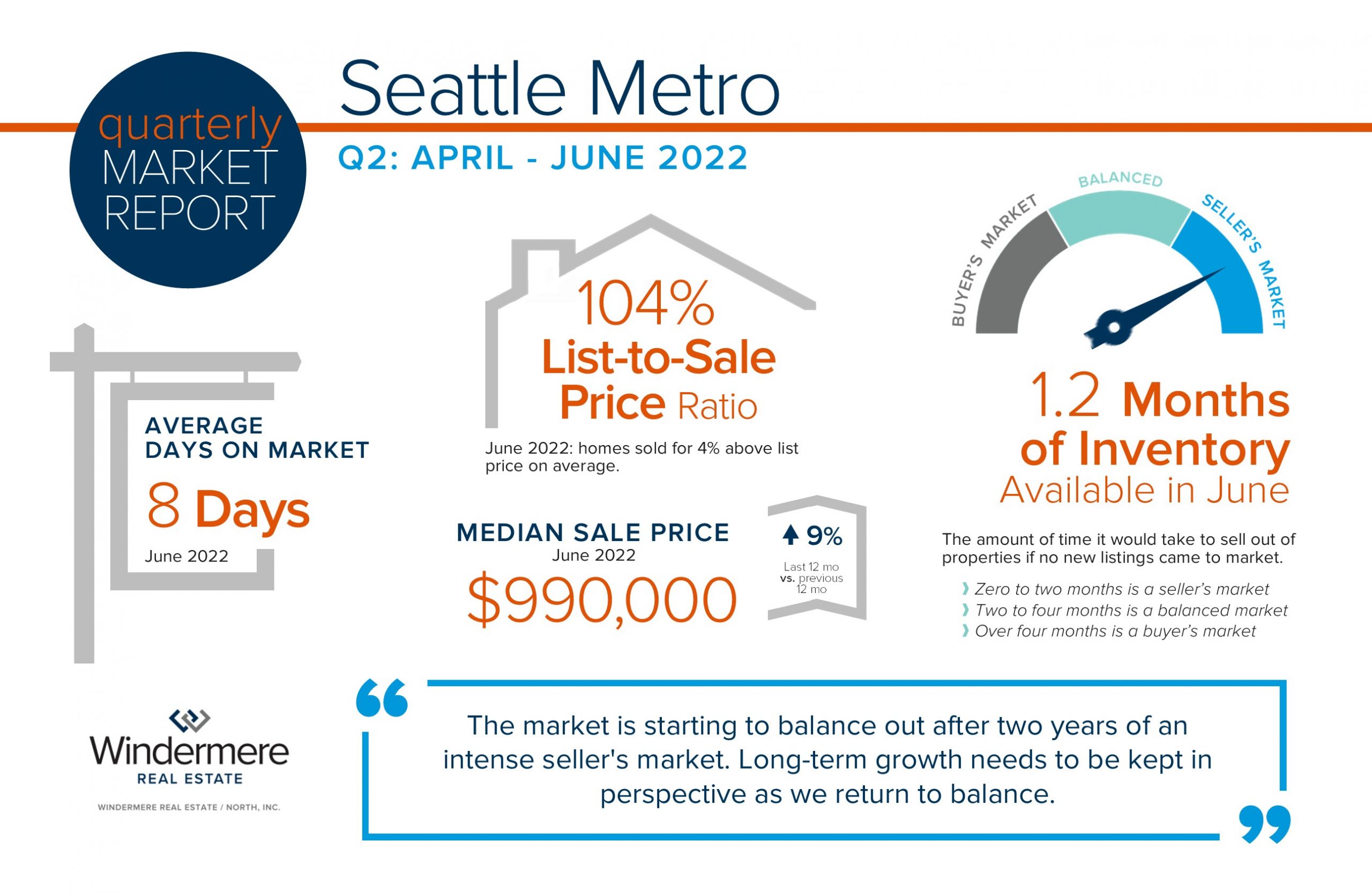

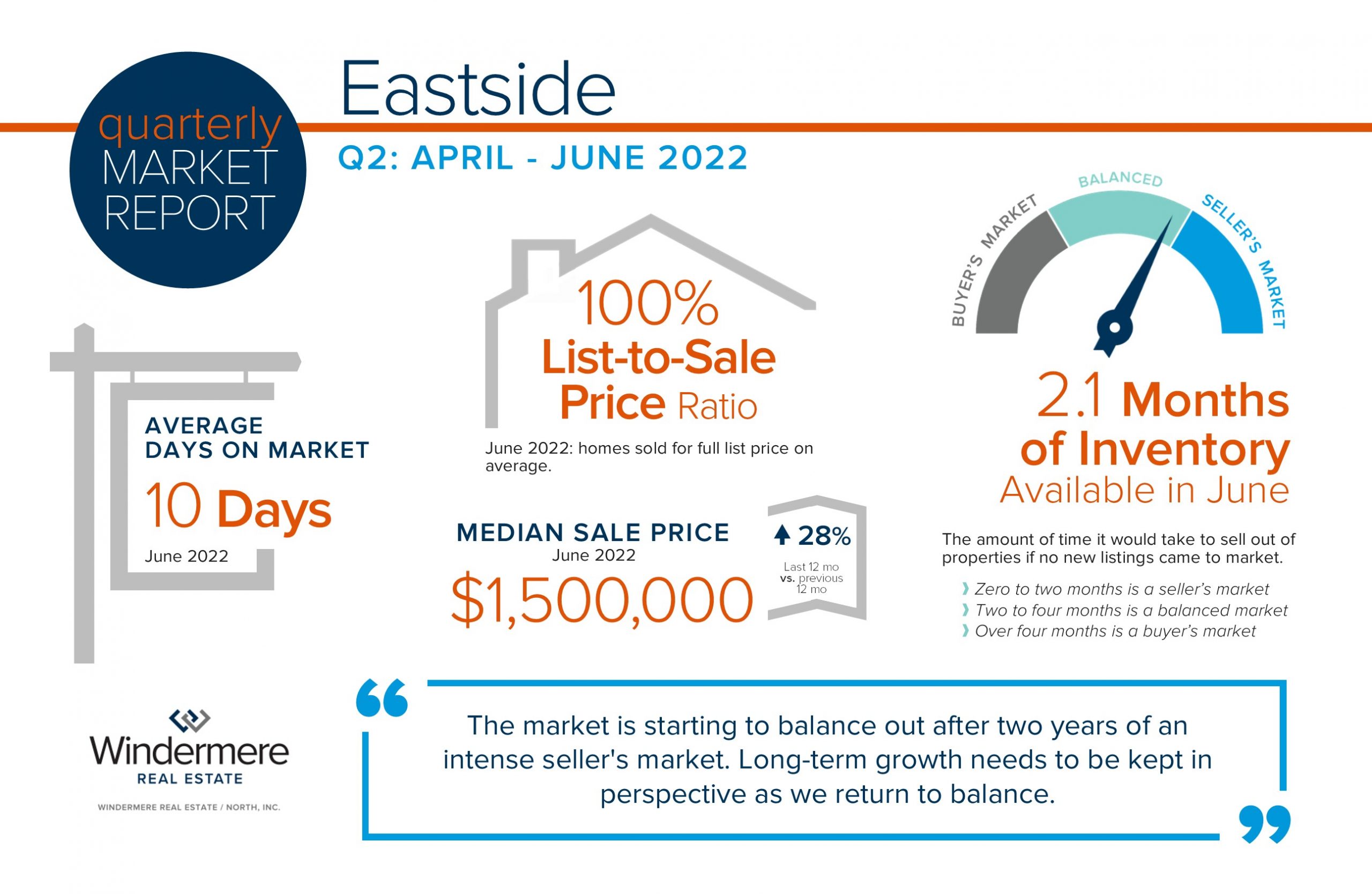

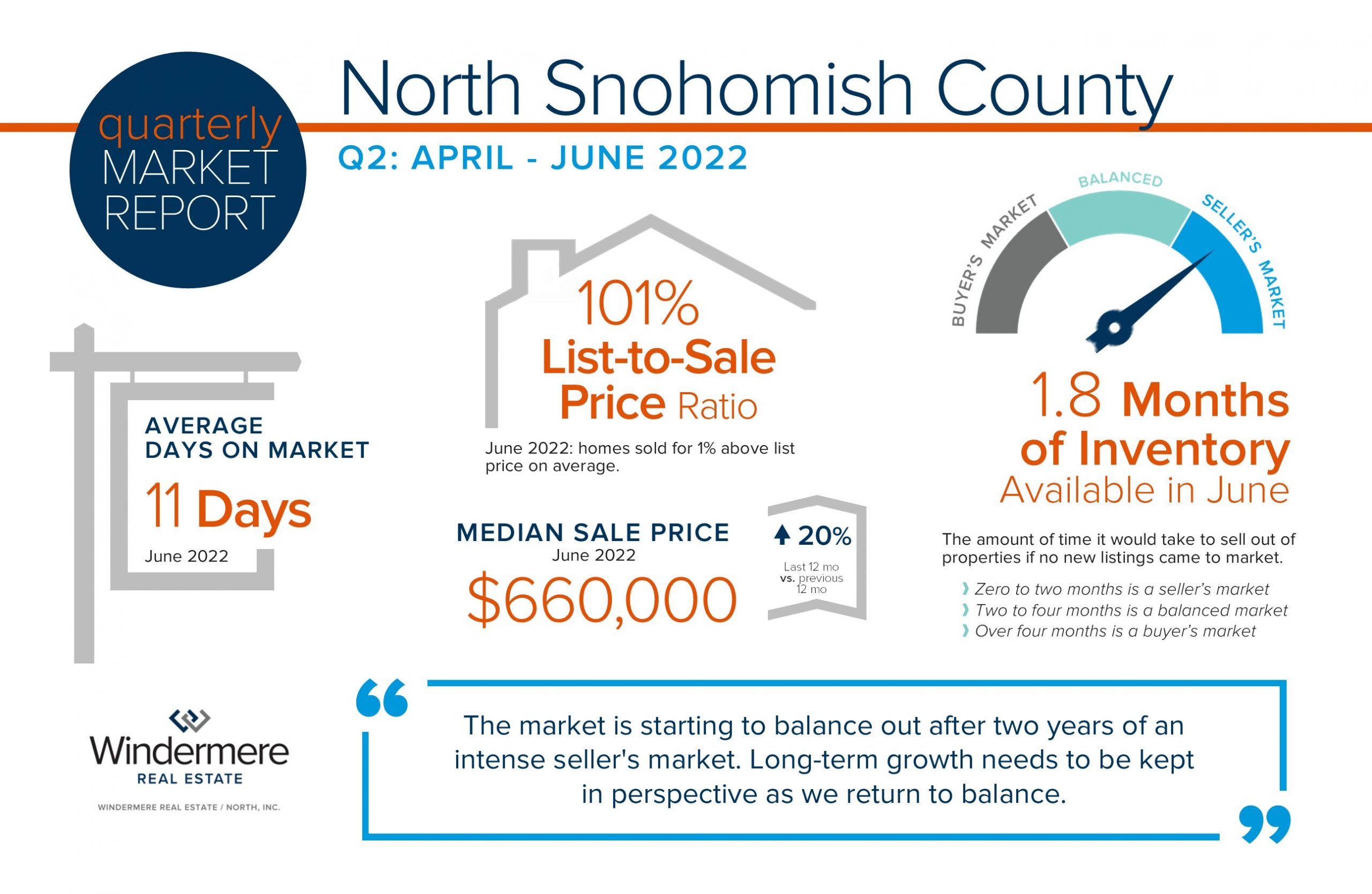

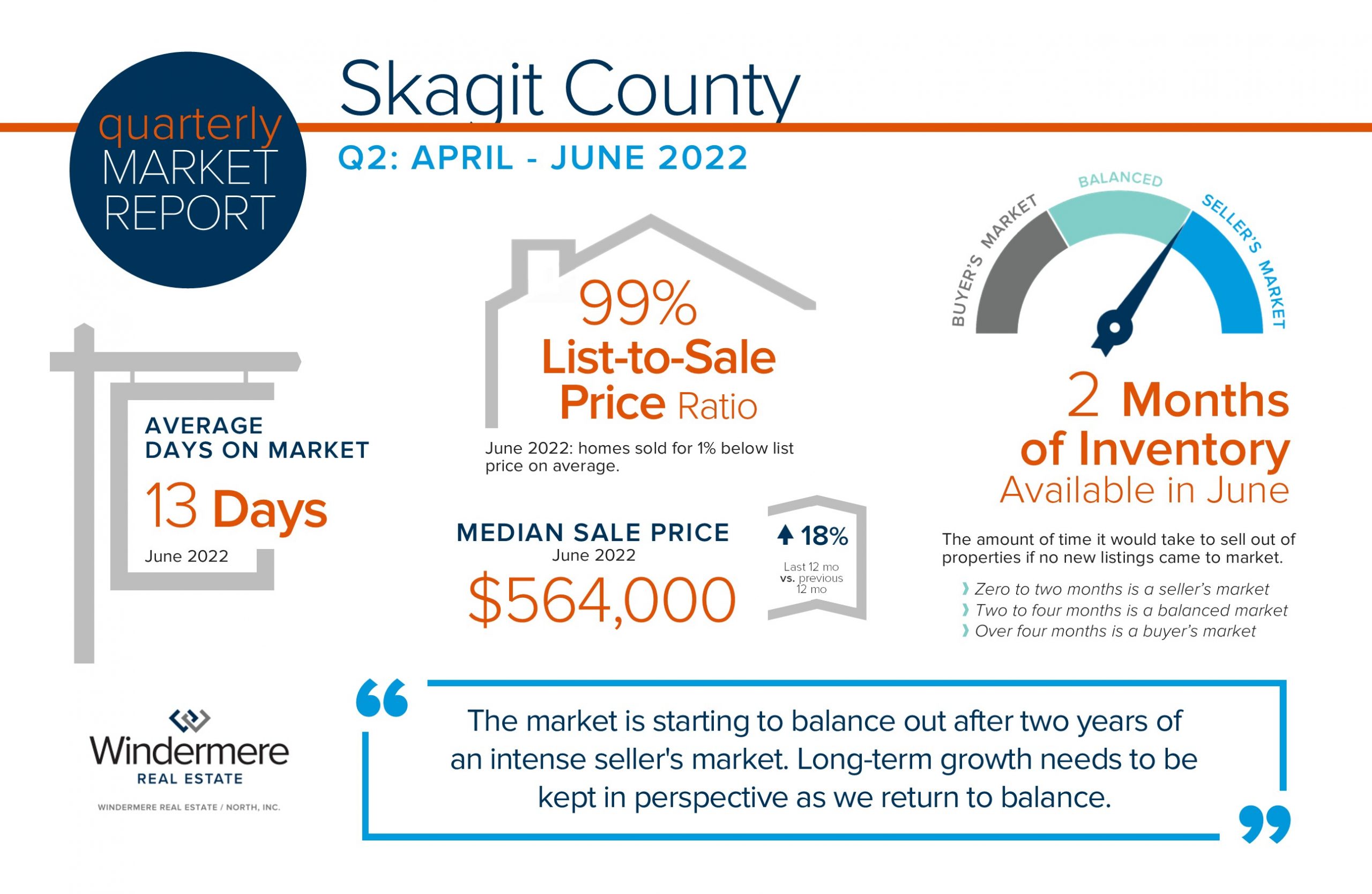

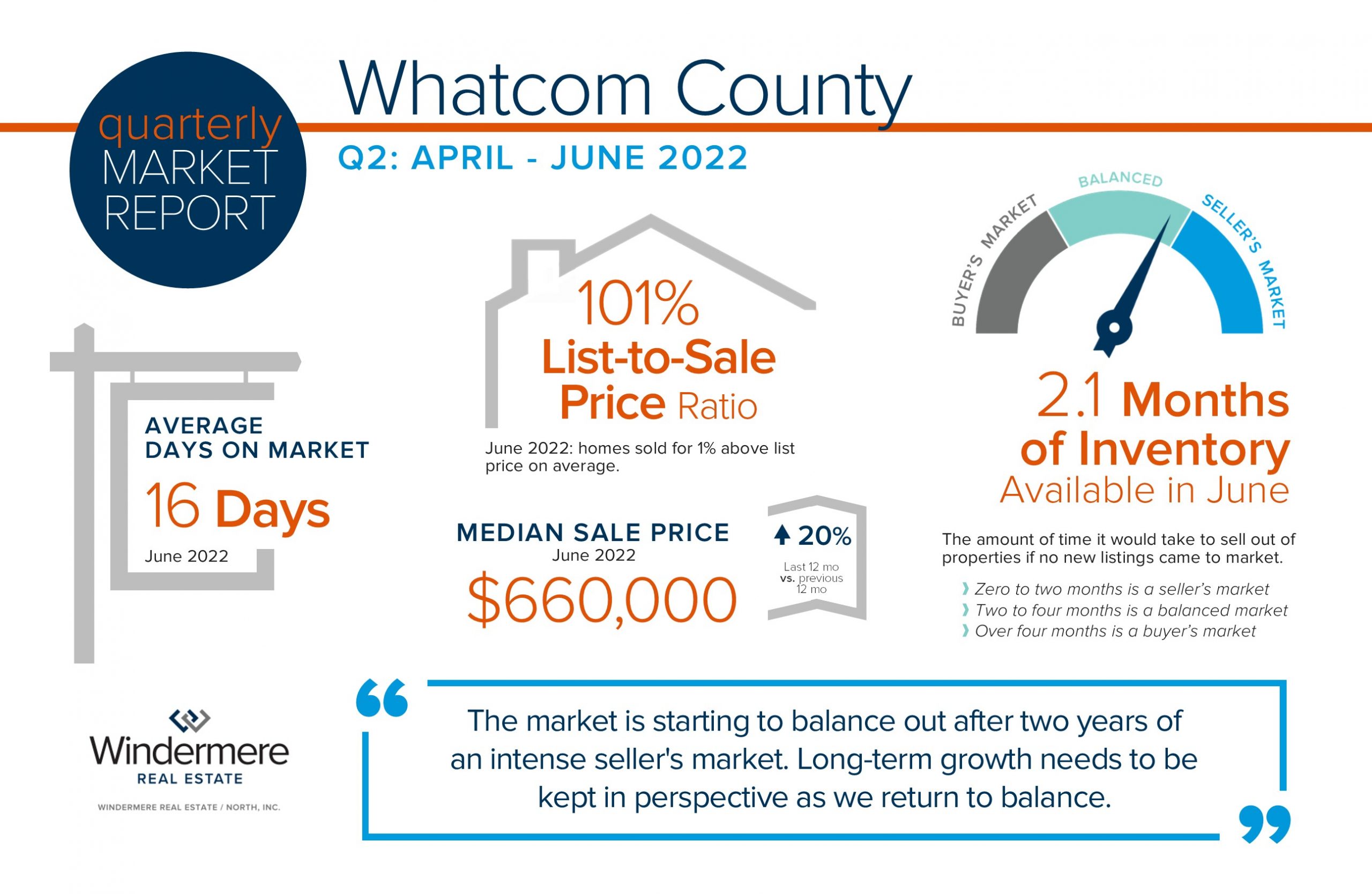

Quarterly Market Reports for Q2 2022

As we head into the second half of 2022, we are experiencing a shift in the real estate market. The market is starting to balance out after two years of an intense seller’s market. Q1 this year had the lowest amount of inventory we have ever seen, which put upward pressure on prices. With the addition of more homes coming to market in Q2 and a 2-point increase in interest rates since the beginning of the year, price appreciation is starting to decelerate. We are coming off the peak prices of Q1 due to these environmental adjustments but are still sitting on top of hefty year-over-year price gains.

Buyers have more selection to choose from, which has reduced the number of multiple offers and tempered price escalations. This has resulted in days on market becoming longer as buyers weigh their options. Sellers are still making huge returns as year-over-year price growth has been above average for the last decade. Long-term growth needs to be kept in perspective as we return to balance. If you are curious about how your real estate goals match up with the market, please reach out. It is my goal to help keep my clients informed and empower strong decisions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link